BEIJING, March 15, 2017 /PRNewswire/ -- Yirendai Ltd. (NYSE: YRD) ("Yirendai" or the "Company"), a leading online consumer finance marketplace in China, today announced its unaudited financial results for the quarter and full year ended December 31, 2016.

Starting from the second quarter of 2016, the Company changed its reporting currency from the U.S. dollar ("US$") to the Renminbi ("RMB"), to reduce the impact of increased volatility of the RMB to US$ exchange rate on the Company's reported operating results. The aligning of the reporting currency with the underlying operations will better depict the Company's results of operations for each period. This release contains translations of certain RMB amounts into US$ for convenience[1]. Prior period numbers have been recast into the new reporting currency.

For Three Months Ended |

For Twelve Months Ended |

||||||

in RMB million |

December |

December |

YoY |

December |

December |

YoY |

|

Amount of Loans Facilitated |

6,675.2 |

3,301.5 |

102% |

20,277.9 |

9,557.6 |

112% |

|

Total Net Revenue |

1,071.1 |

451.6 |

137% |

3,238.0 |

1,313.6 |

146% |

|

Total Fees Billed (non-GAAP) |

1,630.4 |

773.6 |

111% |

4,911.2 |

2,154.1 |

128% |

|

Net Income |

379.8 |

83.3 |

356% |

1,116.4 |

275.3 |

305% |

|

Adjusted EBITDA (non-GAAP) |

401.1 |

126.5 |

217% |

1,093.4 |

402.7 |

172% |

|

In the fourth quarter of 2016, Yirendai facilitated RMB 6,675.2 million (US$961.4 million) of loans to 110,785 qualified individual borrowers on its online marketplace, representing a 102% year-over-year growth; 57% of the borrowers were acquired from online channels; 37% of the loan volume was originated from online channels and 98.8% of the online volume was facilitated through the Yirendai mobile application.

In the fourth quarter of 2016, Yirendai facilitated 194,505 investors with total investment amount of RMB 7,806.9 million (US$1,124.4 million), 100% of which was facilitated through its online platform and 85.0% of which was facilitated through its mobile application.

For the fourth quarter of 2016, total net revenue was RMB 1,071.1 million (US$154.3 million), up by 137% from the same period in 2015; net income was RMB 379.8 million (US$54.7 million), representing an increase of 356% from the same period in 2015.

In the full year of 2016, Yirendai facilitated RMB 20,277.9 million (US$2,920.6 million) of loans to 321,019 qualified individual borrowers on its online marketplace, representing a 112% year-over-year growth; 57% of the borrowers were acquired from online channels; 38% of the loan volume was originated from online channels and 97.8% of the online volume was facilitated through the Yirendai mobile application.

In the full year of 2016, Yirendai facilitated 597,765 investors with total investment amount of RMB 25,038.3 million (US$3,606.3 million), 100% of which was facilitated through its online platform and 83.0% of which was facilitated through its mobile application.

For the full year of 2016, total net revenue was RMB 3,238.0 million (US$466.4 million), up 146% from the same period in 2015; net income was RMB 1,116.4 million (US$160.8 million), representing an increase of 305% from the same period in 2015.

"The fourth quarter of 2016 continued to be strong for us as our loan facilitation volume reached another record high of RMB 6.7 billion," commented Ms. Yihan Fang, Chief Executive Officer of Yirendai. "In the past year, we executed a number of initiatives to drive our business growth and enhance our market leadership. We have made remarkable achievements in many fronts, including new product development, credit underwriting, risk management and new partnerships. In our effort to set up best practice in the industry, we have been in frequent communication with governmental authorities relating to the regulatory requirements. In 2017, we will ensure our full compliance with regulatory requirements. In addition, we will continue to invest in brand building and customer engagement for both borrowers and investors. Furthermore, we are committed to driving the robust momentum of business growth by establishing strong partnerships with vertical industries and financial institutions and leveraging the Yirendai Enabling Platform that we launched recently."

"Our solid financial results were mainly driven by the robust growth of loan origination and generally stable operating cost and expenses," said Mr. Dennis Cong, Chief Financial Officer of Yirendai. "Looking into 2017, we are seeing a healthier business environment as the regulation-driven industry consolidation continues. We will continue to grow our marketplace lending business and explore new revenue opportunities by leveraging our established customer base. At the same time, we will enhance cooperation with industry partners to improve customer acquisition efficiency and reduce funding cost. We are confident to continue the momentum of business growth and set our corporate goal of reaching RMB 100 billion loan origination volume per year in 2020."

[1] Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB 6.9430 to US$1.00, the effective noon buying rate for December 30, 2016 as set forth in the H.10 statistical release of the Federal Reserve Board. |

Fourth Quarter 2016 Financial Results

Total amount of loans facilitated in the fourth quarter of 2016 was RMB 6,675.2 million (US$961.4 million), increased by 102% year over year from RMB 3,301.5 million in the same period of 2015, reflecting strong demand for our products and services. As of December 31, 2016, the Yirendai platform had facilitated approximately RMB 32.3 billion (US$4.7 billion) in loan principal since its inception.

Total net revenue in the fourth quarter of 2016 was RMB 1,071.1 million (US$154.3 million), increased by 137% from RMB 451.6 million in the same period of 2015. The increase of total net revenue was mainly attributable to the growth of loan origination volume.

Total fees billed (non-GAAP) in the fourth quarter of 2016 were RMB 1,630.4 million (US$234.8million), increased by 111% from RMB 773.6 million in the same period of 2015, driven by the growth of loan origination volume. Upfront fees billed to borrowers in the fourth quarter of 2016 were RMB 1,468.3 million (US$211.5 million), increased by 100% from RMB 734.9 million in the same period of 2015. Monthly fees billed to borrowers in the fourth quarter of 2016 were RMB 131.3 million (US$18.9 million), increased by 223% from RMB 40.6 million in the same period of 2015. The significant year-over-year increase of monthly fees billed to borrowers was primarily attributable to the increase of loans generated from online channels, which features a fee collection schedule with monthly payments in addition to the upfront portion. Service fees billed to investors in the fourth quarter of 2016 were RMB 135.7 million (US$19.6 million), increased by 196% from RMB 45.9 million in the same period of 2015.

Operating costs and expenses in the fourth quarter of 2016 were RMB 675.6 million (US$97.3 million), compared to RMB 674.4 million in the previous quarter and RMB 326.6 million in the same period of 2015.

Sales and marketing expenses in the fourth quarter of 2016 were RMB 538.0 million (US$77.5 million), compared to RMB 423.0 million in the previous quarter and RMB 243.1 million in the same period of 2015. Sales and marketing expenses in the fourth quarter of 2016 accounted for 8.1% of amount of loans facilitated, increased from 7.5% in the previous quarter and 7.4% in the same period of 2015.

Origination and servicing costs in the fourth quarter of 2016 were RMB 58.0 million (US$8.3 million), compared to RMB 62.4 million in the previous quarter and RMB 38.7 million in the same period of 2015. Origination and servicing costs in the fourth quarter of 2016 accounted for 0.9% of amount of loans facilitated, decreased from 1.1% in the previous quarter and 1.2% in the same period of 2015.

General and administrative expenses in the fourth quarter of 2016 were RMB 79.7 million (US$11.5 million), compared to RMB 189.0 million in the previous quarter and RMB 44.8 million in the same period of 2015. General and administrative expenses in the fourth quarter of 2016 accounted for 7.4% of total net revenue, decreased from 21.6% in the previous quarter and 9.9% in the same period of 2015. In the third quarter of 2016, the Company recognized an expense of RMB 81.3 million related to an organized fraud incident. Excluding the expense mentioned above, general and administrative expenses in the third quarter of 2016 was RMB 107.7 million, accounting for 12.3% of total net revenue. The decrease of general and administrative expenses as percentage of total net revenue was primarily attributable to the improved operating leverage.

Income tax expense in the fourth quarter of 2016 was RMB 30.7 million (US$4.4 million), compared to income tax expense of RMB 44.8 million in the same period of 2015. The decrease of income tax expense was primarily because the Company's subsidiary Yi Ren Heng Ye Technology Development (Beijing) Co., Ltd. became qualified as a software enterprise which is confirmed by local tax bureau and makes it eligible for an exemption of enterprise income tax for 2015 and 2016 and a favorable enterprise income tax rate of 12.5% for 2017, 2018 and 2019.

Net income in the fourth quarter of 2016 was RMB 379.8 million (US$54.7 million), increased by 356% from RMB 83.3 million in the same period of 2015.

Adjusted EBITDA (non-GAAP) in the fourth quarter of 2016 was RMB 401.1 million (US$57.8 million), increased by 82% from RMB 220.7 million in the previous quarter and 217% from RMB 126.5 million in the same period of 2015.

Basic income per ADS in the fourth quarter of 2016 was RMB 6.36 (US$0.92), increased by 10% from RMB 5.76 in the previous quarter and 291% from RMB 1.62 in the same period of 2015.

Diluted income per ADS in the fourth quarter of 2016 was RMB 6.28 (US$0.91), increased by 10% from RMB 5.70 in the previous quarter and 287% from RMB 1.62 in the same period of 2015.

Net cash generated from operating activities[2] in the fourth quarter of 2016 was RMB 836.1 million (US$120.4 million), increased by 86% from RMB 450.6 million in the previous quarter and 150% from RMB 334.7 million in the same period of 2015.

As of December 31, 2016, cash and cash equivalents excluding the risk reserve fund balance was RMB 968.2 million (US$ 139.5 million), compared to RMB 1,106.3 million as of September 30, 2016. The decrease of cash and cash equivalents was primarily due to the Company's increased investment in short-term assets, presented as available-for-sale investments and held-to-maturity investments on balance sheet, to enhance its return from operating cash. As of December 31, 2016, balance of held-to-maturity investments was RMB 98.9 million (US$14.2 million) and balance of available-for-sale investments was RMB 1,158.0 million (US$166.8 million), compared to balance of held-to-maturity investments of RMB 172.5 million and balance of available-for-sale investments of RMB 298.0 million as of September 30, 2016.

Risk Reserve Fund. In the fourth quarter of 2016, Yirendai set aside in the risk reserve fund an amount of RMB 480.7 million (US$69.2 million), which is equal to 7% of the loans facilitated through its marketplace[3] during the period. In the fourth quarter of 2016, the Company made payments in a total amount of RMB 296.5 million (US$42.7 million) out of the risk reserve fund to pay out the outstanding principal and accrued interest of default loans. As of December 31, 2016, restricted cash balance associated with the risk reserve fund was RMB 1,114.8 million (US$160.6 million), compared to RMB 930.7 million as of September 30, 2016. As of December 31, 2016, the principal balance of performing loans[4] covered by the risk reserve fund was RMB 20,103.0 million (US$2,895.4 million), compared to RMB 16,204.6 million as of September 30, 2016.

In the fourth quarter of 2016, Yirendai accrued liabilities from risk reserve fund guarantee of RMB 528.9 million (US$76.2 million), which is equal to 8% of the loans facilitated through its marketplace during the period. During the quarter, the Company released liabilities of RMB 296.5 million (US$42.7 million) to pay out the outstanding principal and accrued interest of default loans. As of December 31, 2016, liabilities from risk reserve fund guarantee was RMB 1,471.0 million (US$211.9 million).

Delinquency rates. As of December 31, 2016, the overall delinquency rate for loans that are 15-89 days past due was 1.7%, decreased from 1.9% as of September 30, 2016. The decrease of delinquency rates was due to the increase of loan facilitation volume and more efficient risk management for loans generated from offline channels.

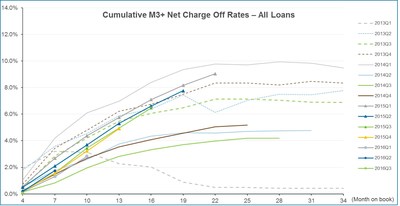

Cumulative M3+ net charge-off rates[5]. As of December 31, 2016, the cumulative M3+ net charge-off rates for Grade A, B, C, and D loans originated in 2015 were 5.1%, 6.6%, 8.2% and 6.7%, respectively, compared to 4.6%, 5.3%, 6.7% and 5.2% as of September 30, 2016. As the 2015 vintage loans continues to mature, the charge off level is consistent with our risk performance expectation.

[2] Starting from the fourth quarter of 2016, the Company early adopt ASU 2016-18, that includes restricted cash in cash and cash equivalent balances in the statement of cash flows, and apply to all periods presented retrospectively. |

[3] In the fourth quarter of 2016, the Company facilitated RMB 64.6 million (US$9.3 million) of loans invested by a trust, which was not covered by the risk reserve fund. The Company transferred cash to the trust in an amount equal to 7% of the loan amount as a security fund to protect the trust from potential losses resulting from defaults of these loans. |

[4] Performing loans refer to loans on which payments of interest and principal are less than 90 days past due. |

[5] Starting from the fourth quarter of 2016, the Company adjusted the calculation of M3+ net charge-off rate to better reflect the performance of loans. The related numbers reported in prior periods have been adjusted for comparison to the numbers as of December 31, 2016. The adjusted "M3+ net charge-off rate," with respect to loans facilitated during a specified time period, which we refer to as a vintage, is defined as the difference between (i) the total balance of outstanding principal of loans that become over three months delinquent during a specified period and (ii) the total amount of recovered past due payments of principal and accrued interest in the same period with respect to all loans in the same vintage that have ever become over three months delinquent, divided by (iii) the total initial principal of the loans facilitated in such vintage. |

Other Operating Metrics and Business Results

Business Outlook

Based on the information available as of the date of this press release, Yirendai provides the following outlook, which reflects the Company's current and preliminary view and is subject to change. The following outlook does not take into consideration the impact of stock-based compensation expenses.

First Quarter 2017

Full Year 2017

Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses several non-GAAP financial measures, such as fees billed and adjusted EBITDA as supplemental measures to review and assess operating performance. We believe that fees billed and adjusted EBITDA provide useful information about our core operating results, enhance the overall understanding of our past performance and prospects and allow for greater visibility with respect to key metrics used by our management in our financial and operational decision-making. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"). The non-GAAP financial measures have limitations as analytical tools. Other companies, including peer companies in the industry, may calculate these non-GAAP measures differently, which may reduce their usefulness as a comparative measure. The Company compensates for these limitations by reconciling the non-GAAP financial measures to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating our performance. See "Operating Highlights and Reconciliation of GAAP to Non-GAAP measures" at the end of this press release.

Currency Conversion

Effective April 1, 2016, the Company changed its reporting currency from US$ to RMB. The change in reporting currency is to reduce the impact of increased volatility of the RMB to the US$ exchange rate on the Company's reported operating results. The aligning of the reporting currency with the underlying operations will better depict the Company's results of operations for each period. Prior to April 1, 2016, the Company reported its annual and quarterly consolidated statement of operations, cash flow data and balance sheet in US$. In this announcement, the unaudited financial results for the quarter ended December 31, 2016 are stated in RMB. The related financial statements prior to April 1, 2016 have been recast to reflect RMB as the reporting currency for comparison to the financial results for the quarter and the year ended December 31, 2016.

This announcement contains currency conversions of certain RMB amounts into US$ at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to US$ are made at a rate of RMB 6.9430 to US$1.00, the effective noon buying rate for December 30, 2016 as set forth in the H.10 statistical release of the Federal Reserve Board.

Conference Call

Yirendai will host a conference call to discuss about its fourth quarter and full year 2016 financial results at 8:00 AM U.S. Eastern Time on March 16, 2017, which corresponds to 8:00 PM Beijing/Hong Kong time on the same day.

The dial-in details for the live conference call are as follows:

International: |

1-412-902-4272 |

U.S. Toll Free: |

1-888-346-8982 |

Hong Kong Toll Free: |

800-905945 |

China Toll Free: |

4001-201203 |

Conference ID: |

Yirendai |

A replay of the conference call will be available until March 23, 2017 by dialing:

International: |

1-412-317-0088 |

U.S. Toll Free: |

1-877-344-7529 |

Replay Access Code: |

10101641 |

A live and archived webcast of the conference call will be available on Yirendai's website at yirendai.investorroom.com.

Safe Harbor Statement

This press release contains forward-looking statements. These statements constitute "forward-looking" statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "target," "confident" and similar statements. Such statements are based upon management's current expectations and current market and operating conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond Yirendai's control. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited to, uncertainties as to Yirendai's ability to attract and retain borrowers and investors on its marketplace, its ability to introduce new loan products and platform enhancements, its ability to compete effectively, PRC regulations and policies relating to the peer-to-peer lending service industry in China, general economic conditions in China, and Yirendai's ability to meet the standards necessary to maintain listing of its ADSs on the NYSE or other stock exchange, including its ability to cure any non-compliance with the NYSE's continued listing criteria. Further information regarding these and other risks, uncertainties or factors is included in Yirendai's filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and Yirendai does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law.

About Yirendai

Yirendai Ltd. (NYSE: YRD) is a leading online consumer finance marketplace in China connecting investors and individual borrowers. The Company provides an effective solution to address largely underserved investor and individual borrower demand in China through an online platform that automates key aspects of its operations to efficiently match borrowers with investors and execute loan transactions. Yirendai deploys a proprietary risk management system, which enables the Company to effectively assess the creditworthiness of borrowers, appropriately price the risks associated with borrowers, and offer quality loan investment opportunities to investors. Yirendai's online marketplace provides borrowers with quick and convenient access to consumer credit at competitive prices and investors with easy and quick access to an alternative asset class with attractive returns. For more information, please visit yirendai.investorroom.com.

For investor and media inquiries, please contact:

Yirendai

Hui (Matthew) Li

Director of Investor Relations

Email: matthewli@yirendai.com

Christensen IR

In China

Christian Arnell

Phone: +86 (0) 10-59001548

Email: carnell@christensenir.com

In U.S.

Linda Bergkamp

Phone: +1 (480) 614-3004

Email: lbergkamp@christensenir.com

Unaudited Condensed Consolidated Statements of Operations |

||||||||||||||

(in thousands, except for share, per share and per ADS data, and percentages) |

||||||||||||||

For the Three Months Ended |

For the Year Ended |

|||||||||||||

December |

September |

December |

December |

December |

December |

December |

||||||||

RMB |

RMB |

RMB |

USD |

RMB |

RMB |

USD |

||||||||

Net revenue: |

||||||||||||||

Loan facilitation services |

436,149 |

848,322 |

1,036,630 |

149,306 |

1,278,539 |

3,133,423 |

451,307 |

|||||||

Post-origination services |

12,586 |

23,487 |

25,039 |

3,606 |

27,086 |

84,154 |

12,121 |

|||||||

Others |

2,881 |

4,902 |

9,441 |

1,360 |

8,014 |

20,414 |

2,940 |

|||||||

Total net revenue |

451,616 |

876,711 |

1,071,110 |

154,272 |

1,313,639 |

3,237,991 |

466,368 |

|||||||

Operating costs and expenses: |

||||||||||||||

Sales and marketing |

243,115 |

423,003 |

537,953 |

77,481 |

679,771 |

1,571,038 |

226,277 |

|||||||

Origination and servicing |

38,680 |

62,449 |

57,955 |

8,347 |

97,693 |

199,811 |

28,778 |

|||||||

General and administrative |

44,809 |

188,961 |

79,714 |

11,481 |

137,114 |

402,111 |

57,916 |

|||||||

Total operating costs and expenses |

326,604 |

674,413 |

675,622 |

97,309 |

914,578 |

2,172,960 |

312,971 |

|||||||

Interest income |

3,114 |

9,778 |

14,778 |

2,128 |

4,799 |

36,843 |

5,306 |

|||||||

Non operating income, net |

- |

259 |

225 |

32 |

- |

575 |

83 |

|||||||

Income before provision for income taxes |

128,126 |

212,335 |

410,491 |

59,123 |

403,860 |

1,102,449 |

158,786 |

|||||||

Income tax expense/(benefit) |

44,835 |

(131,946) |

30,710 |

4,423 |

128,521 |

(13,949) |

(2,009) |

|||||||

Net income |

83,291 |

344,281 |

379,781 |

54,700 |

275,339 |

1,116,398 |

160,795 |

|||||||

Weighted average number of ordinary |

102,586,957 |

119,441,029 |

119,493,662 |

119,493,662 |

100,652,055 |

118,240,414 |

118,240,414 |

|||||||

Basic income per share |

0.8119 |

2.8824 |

3.1783 |

0.4578 |

2.7356 |

9.4418 |

1.3599 |

|||||||

Basic income per ADS |

1.6238 |

5.7648 |

6.3566 |

0.9156 |

5.4712 |

18.8836 |

2.7198 |

|||||||

Weighted average number of ordinary |

102,586,957 |

120,861,971 |

120,859,390 |

120,859,390 |

100,652,055 |

118,937,082 |

118,937,082 |

|||||||

Diluted income per share |

0.8119 |

2.8485 |

3.1423 |

0.4526 |

2.7356 |

9.3865 |

1.3519 |

|||||||

Diluted income per ADS |

1.6238 |

5.6970 |

6.2846 |

0.9052 |

5.4712 |

18.7730 |

2.7038 |

|||||||

Unaudited Condensed Consolidated |

||||||||||||||

Cash and cash equivalents |

846,120 |

1,106,262 |

968,225 |

139,453 |

846,120 |

968,225 |

139,453 |

|||||||

Restricted cash |

483,965 |

974,345 |

1,218,286 |

175,470 |

483,965 |

1,218,286 |

175,470 |

|||||||

Loans at fair value |

221,268 |

367,949 |

371,033 |

53,440 |

221,268 |

371,033 |

53,440 |

|||||||

Held-to-maturity investments |

30,000 |

172,500 |

98,917 |

14,247 |

30,000 |

98,917 |

14,247 |

|||||||

Available-for-sale investments |

- |

298,000 |

1,158,000 |

166,787 |

- |

1,158,000 |

166,787 |

|||||||

Other assets |

608,650 |

1,111,946 |

968,927 |

139,555 |

608,650 |

968,927 |

139,555 |

|||||||

Total assets |

2,190,003 |

4,031,002 |

4,783,388 |

688,952 |

2,190,003 |

4,783,388 |

688,952 |

|||||||

Liabilities from risk reserve fund guarantee |

546,332 |

1,238,689 |

1,471,000 |

211,868 |

546,332 |

1,471,000 |

211,868 |

|||||||

Payable to investors at fair value |

252,907 |

355,340 |

418,686 |

60,303 |

252,907 |

418,686 |

60,303 |

|||||||

Other liabilities |

413,821 |

695,907 |

753,783 |

108,568 |

413,821 |

753,783 |

108,568 |

|||||||

Total liabilities |

1,213,060 |

2,289,936 |

2,643,469 |

380,739 |

1,213,060 |

2,643,469 |

380,739 |

|||||||

Total equity |

976,943 |

1,741,066 |

2,139,919 |

308,213 |

976,943 |

2,139,919 |

308,213 |

|||||||

Unaudited Condensed Consolidated |

||||||||||||||

Net cash generated from operating activities |

334,701 |

450,583 |

836,055 |

120,417 |

861,277 |

2,113,435 |

304,398 |

|||||||

Net cash provided by/(used in) investing |

(194,918) |

(679,486) |

(807,744) |

(116,339) |

(282,589) |

(1,421,663) |

(204,762) |

|||||||

Net cash (used in)/provided by financing |

749,918 |

179,221 |

60,400 |

8,699 |

749,918 |

135,298 |

19,487 |

|||||||

Effect of foreign exchange rate changes |

359 |

1,323 |

17,193 |

2,476 |

101 |

29,356 |

4,228 |

|||||||

Net increase/(decrease) in cash and cash |

890,060 |

(48,359) |

105,904 |

15,253 |

1,328,707 |

856,426 |

123,351 |

|||||||

Cash, cash equivalents and restricted |

440,025 |

2,128,966 |

2,080,607 |

299,670 |

1,378 |

1,330,085 |

191,572 |

|||||||

Cash, cash equivalents and restricted |

1,330,085 |

2,080,607 |

2,186,511 |

314,923 |

1,330,085 |

2,186,511 |

314,923 |

|||||||

Operating Highlights and Reconciliation of GAAP to Non-GAAP Measures |

|||||||||||||

(in thousands, except for number of borrowers, number of investors and percentages) |

|||||||||||||

For the Three Months Ended |

For the Year Ended |

||||||||||||

December |

September |

December |

December |

December |

December |

December |

|||||||

RMB |

RMB |

RMB |

USD |

RMB |

RMB |

USD |

|||||||

Operating Highlights: |

|||||||||||||

Amount of loans facilitated |

3,301,547 |

5,617,485 |

6,675,240 |

961,435 |

9,557,613 |

20,277,927 |

2,920,629 |

||||||

Loans generated from online channels |

1,135,590 |

2,275,473 |

2,462,791 |

354,716 |

3,152,272 |

7,745,724 |

1,115,616 |

||||||

Loans generated from offline channels |

2,165,957 |

3,342,012 |

4,212,449 |

606,719 |

6,405,341 |

12,532,203 |

1,805,013 |

||||||

Fees billed |

773,581 |

1,322,598 |

1,630,358 |

234,821 |

2,154,099 |

4,911,221 |

707,363 |

||||||

Remaining principal of performing loans |

8,969,949 |

17,028,346 |

20,780,617 |

2,993,031 |

8,969,949 |

20,780,617 |

2,993,031 |

||||||

Remaining principal of performing loans |

7,690,401 |

16,204,583 |

20,103,043 |

2,895,440 |

7,690,401 |

20,103,043 |

2,895,440 |

||||||

Number of borrowers |

48,072 |

92,479 |

110,785 |

110,785 |

146,390 |

321,019 |

321,019 |

||||||

Borrowers from online channels |

25,506 |

54,585 |

63,010 |

63,010 |

74,000 |

184,430 |

184,430 |

||||||

Borrowers from offline channels |

22,566 |

37,894 |

47,775 |

47,775 |

72,390 |

136,589 |

136,589 |

||||||

Number of investors |

177,501 |

177,499 |

194,505 |

194,505 |

326,055 |

597,765 |

597,765 |

||||||

Investors from online channels |

177,501 |

177,499 |

194,505 |

194,505 |

317,051 |

597,765 |

597,765 |

||||||

Investors from offline channels |

- |

- |

- |

- |

9,004 |

- |

- |

||||||

Adjusted EBITDA |

126,479 |

220,716 |

401,146 |

57,778 |

402,696 |

1,093,437 |

157,488 |

||||||

Adjusted EBITDA margin |

28.0% |

25.2% |

37.5% |

37.5% |

30.7% |

33.8% |

33.8% |

||||||

Reconciliation of Net Revenues |

|||||||||||||

Fees billed: |

|||||||||||||

Transaction fees billed to borrowers |

775,580 |

1,298,247 |

1,599,674 |

230,401 |

2,179,611 |

4,830,566 |

695,746 |

||||||

Upfront fees billed to borrowers |

734,934 |

1,192,449 |

1,468,330 |

211,484 |

2,099,146 |

4,450,465 |

641,000 |

||||||

Monthly fees billed to borrowers |

40,646 |

105,798 |

131,344 |

18,917 |

80,465 |

380,101 |

54,746 |

||||||

Service fees billed to investors |

45,936 |

110,943 |

135,747 |

19,552 |

97,816 |

399,311 |

57,513 |

||||||

Others |

3,053 |

5,196 |

10,007 |

1,441 |

8,489 |

21,639 |

3,117 |

||||||

Value-added tax |

(50,988) |

(91,788) |

(115,070) |

(16,573) |

(131,817) |

(340,295) |

(49,013) |

||||||

Total fees billed |

773,581 |

1,322,598 |

1,630,358 |

234,821 |

2,154,099 |

4,911,221 |

707,363 |

||||||

Stand-ready liabilities associated |

(244,329) |

(430,569) |

(528,852) |

(76,171) |

(682,254) |

(1,598,238) |

(230,194) |

||||||

Deferred revenue |

(73,074) |

(16,553) |

(18,545) |

(2,671) |

(117,484) |

(71,322) |

(10,272) |

||||||

Cash incentives |

(21,964) |

(24,074) |

(42,836) |

(6,170) |

(80,952) |

(98,173) |

(14,140) |

||||||

Value-added tax |

17,402 |

25,309 |

30,985 |

4,463 |

40,230 |

94,503 |

13,611 |

||||||

Net revenues |

451,616 |

876,711 |

1,071,110 |

154,272 |

1,313,639 |

3,237,991 |

466,368 |

||||||

Reconciliation of EBITDA |

|||||||||||||

Net income |

83,291 |

344,281 |

379,781 |

54,700 |

275,339 |

1,116,398 |

160,795 |

||||||

Interest income |

(3,114) |

(9,778) |

(14,778) |

(2,128) |

(4,799) |

(36,843) |

(5,306) |

||||||

Income tax expense |

44,835 |

(131,946) |

30,710 |

4,423 |

128,521 |

(13,949) |

(2,009) |

||||||

Depreciation and amortization |

1,467 |

2,816 |

3,554 |

512 |

3,635 |

10,609 |

1,528 |

||||||

Share-based compensation |

- |

15,343 |

1,879 |

271 |

- |

17,222 |

2,480 |

||||||

Adjusted EBITDA |

126,479 |

220,716 |

401,146 |

57,778 |

402,696 |

1,093,437 |

157,488 |

||||||

Delinquency Rates |

||||||

Delinquent for |

||||||

15-29 days |

30-59 days |

60-89 days |

||||

December 31, 2013 |

0.2% |

0.4% |

0.3% |

|||

December 31, 2014 |

0.3% |

0.2% |

0.2% |

|||

December 31, 2015 |

0.4% |

0.5% |

0.4% |

|||

December 31, 2016 |

0.4% |

0.7% |

0.6% |

|||

Online Channels |

||||||

December 31, 2013 |

0.1% |

0.9% |

0.3% |

|||

December 31, 2014 |

0.4% |

0.3% |

0.2% |

|||

December 31, 2015 |

0.6% |

0.8% |

0.6% |

|||

December 31, 2016 |

0.6% |

1.0% |

0.8% |

|||

Offline Channels |

||||||

December 31, 2013 |

0.3% |

0.2% |

0.2% |

|||

December 31, 2014 |

0.3% |

0.2% |

0.2% |

|||

December 31, 2015 |

0.3% |

0.4% |

0.3% |

|||

December 31, 2016 |

0.4% |

0.6% |

0.4% |

|||

Net Charge-Off Rate |

||||||||

Loan |

Pricing grade |

Amount of loans |

Accumulated M3+ Net |

Total Net Charge-Off |

||||

(in RMB thousands) |

(in RMB thousands) |

|||||||

2013 |

A |

258,322 |

18,517 |

7.2% |

||||

B |

- |

- |

- |

|||||

C |

- |

- |

- |

|||||

D |

- |

- |

- |

|||||

Total |

258,322 |

18,517 |

7.2% |

|||||

2014 |

A |

1,917,542 |

94,532 |

4.9% |

||||

B |

303,030 |

19,934 |

6.6% |

|||||

C |

- |

- |

- |

|||||

D |

7,989 |

501 |

6.3% |

|||||

Total |

2,228,561 |

114,968 |

5.2% |

|||||

2015 |

A |

873,995 |

44,754 |

5.1% |

||||

B |

419,630 |

27,665 |

6.6% |

|||||

C |

557,414 |

45,727 |

8.2% |

|||||

D |

7,706,575 |

513,090 |

6.7% |

|||||

Total |

9,557,613 |

631,236 |

6.6% |

|||||

2016 |

A |

1,111,974 |

2,684 |

0.2% |

||||

B |

755,132 |

4,686 |

0.6% |

|||||

C |

1,417,430 |

14,465 |

1.0% |

|||||

D |

16,993,392 |

159,457 |

0.9% |

|||||

Total |

20,277,927 |

181,292 |

0.9% |

|||||

Net Charge-Off Rate |

||||||||||||

Loan issued |

Month on Book |

|||||||||||

4 |

7 |

10 |

13 |

16 |

19 |

22 |

25 |

28 |

31 |

34 |

||

2013Q1 |

1.9% |

3.2% |

3.1% |

2.3% |

2.0% |

0.9% |

0.5% |

0.5% |

0.4% |

0.4% |

0.4% |

|

2013Q2 |

1.8% |

3.6% |

4.5% |

5.9% |

6.4% |

7.4% |

6.1% |

7.0% |

7.5% |

7.5% |

7.8% |

|

2013Q3 |

0.5% |

2.8% |

4.2% |

5.5% |

6.1% |

6.5% |

7.1% |

7.1% |

7.0% |

6.9% |

6.9% |

|

2013Q4 |

0.7% |

3.4% |

4.8% |

6.2% |

6.8% |

7.5% |

8.3% |

8.3% |

8.2% |

8.5% |

8.3% |

|

2014Q1 |

1.0% |

4.2% |

6.1% |

7.0% |

8.4% |

9.3% |

9.8% |

9.7% |

9.9% |

9.8% |

9.5% |

|

2014Q2 |

0.5% |

1.8% |

2.6% |

3.8% |

4.3% |

4.6% |

4.6% |

4.7% |

4.7% |

4.8% |

||

2014Q3 |

0.2% |

0.8% |

2.0% |

2.8% |

3.3% |

3.7% |

4.0% |

4.2% |

4.2% |

|||

2014Q4 |

0.3% |

1.5% |

2.7% |

3.5% |

4.1% |

4.6% |

5.1% |

5.2% |

||||

2015Q1 |

0.6% |

2.7% |

4.4% |

5.8% |

7.1% |

8.2% |

9.0% |

|||||

2015Q2 |

0.5% |

2.1% |

3.7% |

5.3% |

6.6% |

7.8% |

||||||

2015Q3 |

0.2% |

1.6% |

3.4% |

4.9% |

6.5% |

|||||||

2015Q4 |

0.2% |

1.6% |

3.2% |

4.9% |

||||||||

2016Q1 |

0.2% |

1.3% |

2.8% |

|||||||||

2016Q2 |

0.2% |

1.7% |

||||||||||

2016Q3 |

0.1% |

|||||||||||

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/yirendai-reports-fourth-quarter-and-full-year-2016-financial-results-300424157.html