While the global pharmaceutical industry is facing enormous challenges in operation and R&D innovation due to the changing global trend, the South Korean pharmaceutical industry is also facing severe difficulties such as reduced production capacity, tightened regulations, insufficient innovation, and patent expirations. In order to ensure sustained innovations to meet diverse needs of patients, governments, insurance providers, and the market for innovative medicines, pharmaceutical companies have placed a strong emphasis on exploring areas of unmet medical needs. With the support of the South Korean government, these companies are investing approximately 65% of their annual net revenues to secure the production of innovative medicines.

At the same time, South Korea’s biotech and pharmaceutical industries are actively engaged in clinical studies, with the market share of clinical trials led by South Korea climbing from eighth place in 2019 to sixth place in 2020. Over the past few years, the global pharmaceutical and biotech industries have together witnessed how South Korea is becoming increasingly active in the global market as a country with its drug development capabilities.

Related Article: How the Greater Tokyo Region Could Be the Next Promising Biocommunity Ramping Up R&D Capabilities to Capture Global Market

The pharmaceutical industry in South Korea started in the late 1800s when the first modern pharmaceutical company began its operation. Since the introduction of the product patent system in 1987, Korean pharmaceutical companies have not only been engaged in OEM, but also in R&D activities of innovative drugs to cope with the rapid changes in the market. Although the size of the South Korean pharmaceutical industry is relatively small in global terms, accounting for only 1.5% of the world’s total, the market is growing at a rapid rate of 10% annually, far exceeding the 3.5% rate of other developed nations such as the United States. In order to compete with pharmaceutical companies in the United States and the European Union with larger market shares, the South Korean pharmaceutical industry is speeding up developments of novel drugs with the aim of capturing overseas markets as quickly as possible.

In order to gain recognition from international organizations, South Korea joined the Pharmaceutical Inspection Convention and Pharmaceutical Inspection Co-operation Scheme (PIC/S) in 2014 and the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) in 2016 to ensure that new pharmaceutical products are developed in compliance with global regulations. In May 2019, South Korea became the seventh country to be included in the EU Drug Whitelist as the European Council determined that Korea’s medicine-related manufacturing and supervision standards are on par with EU member states. Having the whitelist status, medicines being shipped from South Korea to Europe are exempted from written confirmation to guarantee good manufacturing practice (GMP) standards required in the EU directives.

The short review period for clinical trial applications (about 30 days) and the high efficiency of institutional review board (IRB) review, together with large patient databases in more than 30 hospitals and 170 clinical trial sites have contributed to the rapid and continuous growth in the number of approved clinical trials in South Korea. Korea has become a new choice when global pharmaceutical companies are looking Asian trial centers, after China and Japan.

The South Korean government has also demonstrated its decisiveness in policy by enacting the Special Act on Pharmaceutical Industry Promotion and Support in March 2011, which lays an important foundation for supporting and accelerating the development of the industry by enhancing innovation, pumping in large amounts of R&D funds and building R&D infrastructure. Prior to the Act, the Korean government had been following the pace of the industry by identifying the pharmaceutical and biotechnology industries as one of the 10 fastest growing industries alongside the IT industry and planning medium to long-term development programs.

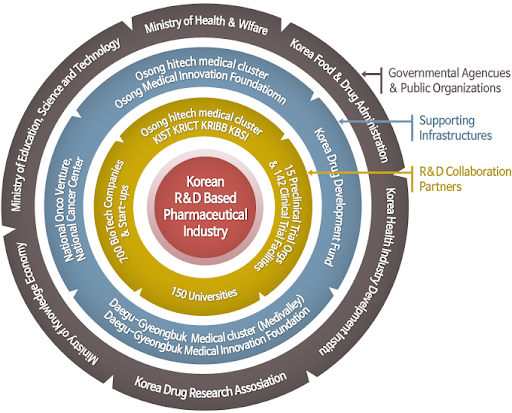

Figure 1: The government-industry relationship in South Korea, source: Korea Drug Research Association, http://www.kdra.or.kr/english/03web04.php

Figure 1: The government-industry relationship in South Korea, source: Korea Drug Research Association, http://www.kdra.or.kr/english/03web04.php

The country’s Ministry of Health and Welfare has designated 46 Korean pharmaceutical companies, including 2 foreign-invested companies, as Korea’s innovative pharmaceutical companies under the Special Act on Pharmaceutical Industry Promotion and Support, providing tax exemptions, preferential government research funding, and deferred price reductions to promote investment and support sustainable growth.

Blooming Biotechnology Landscape in South Korea

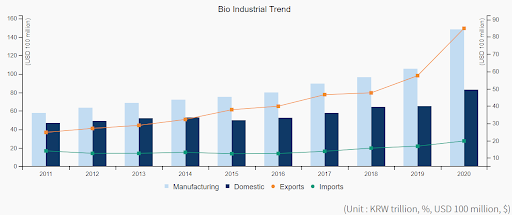

According to the Ministry of Food and Drug Safety (MDFS) of South Korea, the value of South Korea’s domestic pharmaceutical sector reached approximately 24.5 trillion won in 2020, an increase of 10.1% from the previous year and an average growth rate of 6.9% over the last five years. Among all pharmaceutical products, 85.6% of the production value is generated by over-the-counter drugs and 14.4% by medical drugs. In addition, South Korea’s total pharmaceutical exports were US$8.4 billion in 2020, marking a significant increase of 62.5% over the previous year.

Figure 2: Import and export trend of pharmaceutical products of South Korea in recent years, source: Invest Korea, Growth of the Entire Bioindustry, 2020 https://www.investkorea.org/ik-en/cntnts/i-309/web.do?clickArea=enmain00009

Figure 2: Import and export trend of pharmaceutical products of South Korea in recent years, source: Invest Korea, Growth of the Entire Bioindustry, 2020 https://www.investkorea.org/ik-en/cntnts/i-309/web.do?clickArea=enmain00009

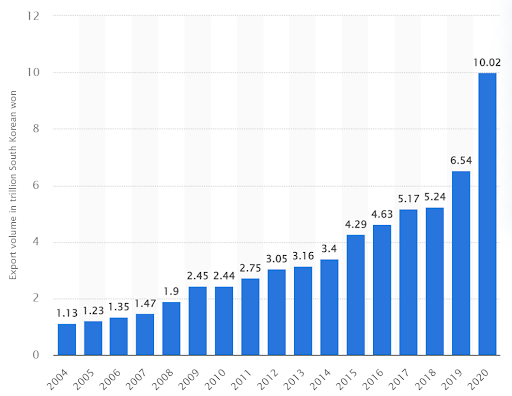

South Korea’s biotech industry is growing even faster in response to the COVID-19 outbreak. According to statistics from Statista in 2022, South Korea’s biotech exports are expected to rise rapidly from 1.13 trillion won in 2004 to 10.02 trillion won in 2022. New venture and R&D industries account for the majority of these exports. Government investment has been scaled up from 2.3 trillion won to 4.1 trillion won over the decade (2010-2020). The private sector’s investment has also increased from 1.1 trillion won in 2010 to 3.9 trillion won in 2019. The number of patents filed has increased from 3,417 in 2010 to 7,347 in 2020. In 2020, the R&D capability of biotechnology in South Korea already reached 77.9%, narrowing the gap by about 3.1 years compared with that of developed countries.

Figure 3: Export volume of the biotechnology industry from South Korea from 2004 to 2020 (in trillion South Korean won), source: Invest Korea, Growth of the Entire Bioindustry, 2020

Figure 3: Export volume of the biotechnology industry from South Korea from 2004 to 2020 (in trillion South Korean won), source: Invest Korea, Growth of the Entire Bioindustry, 2020

https://www.investkorea.org/ik-en/cntnts/i-309/web.do?clickArea=enmain00009 Figure 4: Steady growth of South Korean biotech and R&D companies, source: Biotechnology in Korea, Ministry of Science and ICT, 2022

Figure 4: Steady growth of South Korean biotech and R&D companies, source: Biotechnology in Korea, Ministry of Science and ICT, 2022

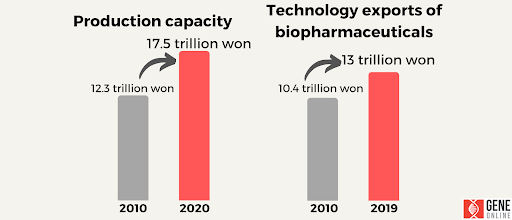

In addition, South Korea’s growth potential in biotechnology has grown significantly, with production capacity increasing from 12.3 trillion to 17.5 trillion won from 2019 to 2020, and technology exports of biopharmaceuticals increasing from 10.4 trillion to 13 trillion won in the same period.

Figure 5: Growth potential of biotechnology in South Korea, source: Biotechnology in Korea, Ministry of Science and ICT, 2022

Figure 5: Growth potential of biotechnology in South Korea, source: Biotechnology in Korea, Ministry of Science and ICT, 2022

Enhancing Overall Competitiveness through Government-Industry Collaboration

The main investment in the Korean government’s 2021 Budget is Bioscience, with another major investment being Red Bio (bio-healthcare), which concentrates on research to combat diseases and promote health-related biotechnology and treatments. Other smaller investments include Green Bio (bio-agriculture), which focuses on food security support and promotion of crop products with high added value, and White Bio (bio-energy), which is responsible for technologies or industries that address environmental impacts such as global warming and resource scarcity. There is also an emerging industry-related portfolio that invests in innovative R&D and enhances global development opportunities for future industries.

Seven Major Biotech Clusters in South Korea

The Korean government is also investing together with the biotech industry, specifically in the field of R&D. In 2019 alone, the total R&D investment in biotechnology by the government and private sector reached KRW 7626.2 billion, of which $3,671.7 billion was invested by the government. At the same time, the Korean government is encouraging more professionals to devote themselves to R&D. By enhancing human resources, technology transfer, patent registration and intellectual property rights applications, South Korea is able to stand out among global biotech companies and become a target of global attention.

The government is also proactively creating a world-class industrial ecosystem in order to promote regional strengths and collaboration among innovation stakeholders. Daedeok Innopolis in Daejeon has been revitalized as a hub of the Korean bioindustry, with a number of research units working closely with the government, as well as research centers and start-up companies affiliated with private companies. As of 2020, it is home to more than 300 biotech companies.

Since its establishment in 2017, Seoul Biohub has been an optimal location for biotech startups due to its geographical advantages. Seoul Biohub is located in the Hongreung area in the northern part of Seoul, which is close to many research centers and major medical institutions, allowing easy access for collaborations. As of 2021, a total of 147 companies have been tenants of Seoul Biohub since its inception. Over the five-year period from 2017 to 2021, Seoul Biohub has attracted approximately KRW 372.1 billion in investment, created 1,260 jobs, and generated revenues totaling KRW 50.4 billion.

A number of new biotech clusters have also emerged in South Korea, each with its own area of expertise. For example, Pangyo Techno Valley, an IT-oriented area, is one of the cradles of the biotech industry, actively leading innovation and integration of existing technologies including biotechnology. Osong High-Tech Medical Complex is an economic zone established to support biomedical-related R&D projects by the government, private sector (e.g. LG Chem), universities and research centers in line with the national strategy. KMedihub (Daegu-Gyengbuk Advanced Medical Industry Cluster) is responsible for supporting new pharmaceutical and medical device research and development by tenant companies. Wonju Techno Valley is leading the development of industries related to hospitals and medical devices.

Located in Incheon City, Songdo Bio Cluster has a global scale of production facilities and it has become one of the fastest growing bio-healthcare clusters in South Korea. As of 2022, Songdo International City is ranked the world’s top city in terms of production of biopharmaceutical products with 560,000 liters. The city also accounts for about 58% and 30% of Korea’s biopharmaceutical exports and investment respectively.

The Korean government is collaborating with the biotech industry to revise laws and regulations to benefit the sector and to take advantage of its own strengths, promising more prosperous growth in the future. In the upcoming article, GeneOnline will continue to cover the advantages of Korean biotech companies in depth and will report directly from BIOPLUS-INTERPHEX KOREA 2022 in early August.

Related Articles:

©www.geneonline.com All rights reserved. Collaborate with us: service@geneonlineasia.com