Launch of Depositary Receipts on TraHK and HSCEI ETF in SET

First DR in Thailand focusing on Hang Seng Index and Hang Seng China Enterprise Index

HONG KONG, Nov. 13, 2023 /PRNewswire/ -- Hang Seng Investment Management Limited ('Hang Seng Investment') has collaborated with Bualuang Securities ('BLS'), a leading securities company in Thailand and a subsidiary of Bangkok Bank, the country's largest bank by assets[1], and welcomes the launch of two Depositary Receipts ('DR') by BLS that invest in the Tracker Fund of Hong Kong (Stock code: 2800) ('TraHK') and the Hang Seng China Enterprises Index ETF (Stock code: 2828) ('HSCEI ETF'). These two DR will make their debut on the Stock Exchange of Thailand ('SET') on 16 November 2023. TraHK and HSCEI ETF are managed by Hang Seng Investment, the largest exchange-traded fund ('ETF') manager in Hong Kong in terms of assets under management[2] ('AUM').

Rosita Lee, Director and Chief Executive Officer of Hang Seng Investment, said, "We are delighted to see TraHK and HSCEI ETF, two of our flagship ETFs, being chosen as the underlying investments of products outside of Hong Kong in the form of DR. These DR offer investors their inaugural chance to invest in TraHK and HSCEI ETF in overseas markets. This not only presents a significant opportunity for overseas investors to diversify their investment portfolios and capture the long-term growth potential of the dynamic markets of Hong Kong and mainland China, but also showcases Hong Kong's unique role as a super-connector between mainland China and the rest of the world. Hang Seng Investment remains committed to actively enhancing our global presence and fostering stronger relationships with market participants worldwide. We will continue to explore and seize new opportunities as a market leader in ETFs."

Bannarong Pichyakorn, Senior Managing Director of BLS stated, "As the first and foremost issuer of DR in Thailand, we are excited to expand the opportunities within Hong Kong's flagship indices through our innovative DR01 solution with HK01 and HKCE01. We are honoured and grateful to collaborate with Hang Seng Investment, the largest ETF manager in Hong Kong by AUM which allows us to offer a broader range of efficient tools for both retail and institutional investors to conveniently access foreign markets and achieve their asset allocation goals through the Stock Exchange of Thailand. Furthermore, we recognise the opportunities within the Hong Kong market due to its attractive valuation along with the economic growth prospects of mainland China and Hong Kong in the long term."

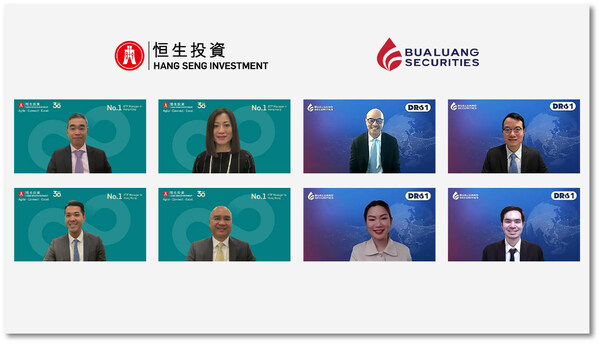

Hang Seng Investment Management Limited (‘Hang Seng Investment’) has collaborated with Bualuang Securities (‘BLS’), and welcomes the launch of two Depositary Receipts by BLS that invest in the Tracker Fund of Hong Kong and the Hang Seng China Enterprises Index ETF. Pictured: Rosita Lee, Director and Chief Executive Officer of Hang Seng Investment (top row, second from left) with Bannarong Pichyakorn, Senior Managing Director of BLS (top row, second from right) and their teams.

Note: |

1. Based on Total Assets. Source: Bloomberg, as at 13 November 2023 |

2. Based on AUM of Hong Kong listed and domiciled ETFs. Source: Hang Seng Investment, as at 30 October 2023 |

About Hang Seng Investment

Hang Seng Investment is celebrating its 30th anniversary this year. Established in 1993, Hang Seng Investment Management Limited ('Hang Seng Investment') is a wholly owned subsidiary of Hang Seng Bank Limited, and is Hong Kong's No. 1 exchange-traded fund ('ETF') manager in terms of assets under management. As a Hong Kong based asset management company specializing in managing funds related to mainland China and Hong Kong markets, Hang Seng Investment is committed to providing investors with comprehensive investment management services through investment managers with extensive experience in managing funds (including a series of ETFs and retail funds) and investment portfolios for institutional and private clients. As a leading home-grown asset manager in Hong Kong, Hang Seng Investment has 30 years of asset management experience.

About Bualuang Securities

Established in 2001, Bualuang Securities is a leading securities company in Thailand, and is broker number one of the Stock Exchange of Thailand's members. It is a subsidiary of Thailand's biggest bank in terms of assets, Bangkok Bank, with Bangkok Bank Public Company Limited as major shareholder to operate capital market business. Bualuang Securities provides full range of securities business services, covering Securities brokerage, Derivatives brokerage, Investment banking, Derivative warrants, Unit trust & Fixed income securities, Stock borrowing and lending, Structured notes issuance, and Global Investing & Depositary Receipt.

The content is prepared by Hang Seng Investment Management Limited ("HSVM") and Bualuang Securities ("BLS") is for reference only. At the time of publication of the content, certain information of the content is obtained and prepared from sources which HSVM and/or BLS believe to be reliable, and neither HSVM nor BLS warrant, guarantee or represent the accuracy, validity or completeness of such information. Under no circumstances shall the content constitute a representation that it is correct as of any time subsequent to the date of publication. HSVM and BLS reserve the right to change the content without notice. The content is the view of HSVM and BLS and does not constitute and should not be regarded as an offer or solicitation to anyone in any jurisdiction to invest into any investment product. Investors should read the relevant investment product's offering document (including the full text of the risk factors and charges stated therein) before making any investment decision. Investment involves risks (including the risk of loss of capital invested), prices of investment product units may go up as well as down, past performance is not indicative of future performance. If investors have any doubt about the content or investment product (including its offering document), they should seek independent professional financial advice. HSVM and BLS will not be liable to anyone for any cost, claims, fees, penalties, loss or liability incurred if the content is improperly used.

The content shall not be duplicated or stored or distributed without the prior written consent of HSVM and BLS. "Hang Seng Investment Management Limited", "恒生投資管理有限公司", "恒生投資管理" , "恒生投資" or any marks containing these names shall not be used without the prior written consent of HSVM.

HSVM and Hang Seng Indexes Company Limited (collectively "Index Companies") are separate and independent entities, The views and opinions of HSVM and BLS do not represent the views or opinions of the Index Companies and HSVM and BLS cannot influence Index Companies on any matter.

The content has not been reviewed by the Securities and Futures Commission and/or regulators in any jurisdiction.