Demand for Generating Stable Passive Income Favoured by Over 80% of Respondents

HONG KONG, Feb. 19, 2024 /PRNewswire/ -- Hong Kong's 'Sandwich Generation' – those supporting both elders and children – is known for its disciplined approach to saving for the future. A recent Hang Seng Bank ('Hang Seng') survey revealed that this group is concerned about their retirement, with a majority yet to save half of their retirement funds. While respondents' ideal retirement age is around 60, more than half face a shortfall of 50% or more from their retirement fund target.

The survey interviewed over 300 people with kids and parents across Hong Kong to better understand the financial concerns and needs of the Sandwich Generation. Findings show that they put aside an average of 21% of their household income for savings or investment. Despite over 80% expressing interest in wealth management products and keen to generate stable passive income, many may be missing out on maximising returns or achieving long-term wealth appreciation due to a lack of confidence in selecting the right wealth management products.

Comprehensive Financial Investment Solutions Help the Sandwich Generation Build Stable Passive Income

To aid the Sandwich Generation in achieving long-term financial stability for their families and future aspirations, without compromising current living standards, Hang Seng's 'IncomePower Life Insurance Plan' offers the chance to generate an annual non-guaranteed income of up to 5% of the Total Premiums Paid, with non-guaranteed monthly income payments beginning from the 25th monthiversary. It also includes the Medical Advance Benefit, which covers three major critical illnesses guaranteed acceptance without the need for a physical examination, catering to customers' evolving needs at different life stages, and facilitates effective legacy planning for wealth succession.

Moreover, Hang Seng offers over 60 fixed income fund product choices and capital-protected structured products that span five major asset classes – foreign exchange, funds, stocks, indices, and interest rates. These options facilitate the generation of passive income without compromising the customers' current standard of living.

Rannie Lee, Head of Wealth and Personal Banking at Hang Seng, said: "The market environment is constantly changing, and different life stages require different financial strategies. Early planning for wealth management, value-added goals, and retirement is crucial for the Sandwich Generation, who balance the responsibility of supporting both their children and aging parents. Combining passive income and insurance, 'IncomePower' is a tailored product that answers to the unique needs of the Sandwich Generation."

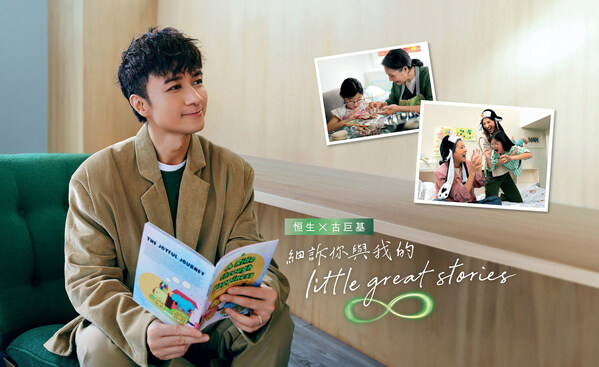

Leo Ku Continues to Join Financial Awareness Drive for Sandwich Generation

Prominent Hong Kong artist Leo Ku remains at the forefront of the Bank's promotional campaign, addressing the financial challenges faced by the Sandwich Generation. Details of the second phase of the campaign will be available on Hang Seng's official YouTube channel (https://youtu.be/03NE5o13mDo).

From now until end of March, customers who open a Prestige Banking account and subscribe to designated wealth management products can enjoy rewards up to $67,800 and up to 25% premium discount is available for the first year to customers who apply for the 'IncomePower' Life Insurance Plans. These services and offers are subject to terms and conditions. For more details, please visit hangseng.com/wem.

Prominent Hong Kong artist Leo Ku remains at the forefront of Hang Seng Bank’s wealth management promotional campaign, addressing the financial challenges faced by the Sandwich Generation.

About Hang Seng Bank

Founded in 1933, Hang Seng has continually innovated to provide best-in-class, customer-centric banking, investment and wealth management services for individuals and businesses. It is widely recognised as the leading domestic bank in Hong Kong, currently serving more than 3.9 million customers.

Combining its award-winning mobile app and strong digital capabilities with a vast network of over 260 service outlets in Hong Kong, Hang Seng offers a seamless omni-channel experience for customers to take care of their banking and financial needs anytime, anywhere.

Its wholly owned subsidiary, Hang Seng Bank (China) Limited, operates a strategic network of outlets in almost 20 major cities in mainland China to serve a growing base of mainland customers locally and those with cross-boundary banking needs. The Bank also operates branches in Macau SAR and Singapore, and a representative office in Taipei.

As a homegrown financial institution, Hang Seng is closely tied to the Hong Kong community. It supports the community with a dedicated programme of social and environmental initiatives focused on future skills for the younger generation, sustainable finance and financial literacy, addressing climate change and caring for the community.

Hang Seng is a principal member of the HSBC Group, one of the world's largest banking and financial services organisations. More information on Hang Seng is available at www.hangseng.com.