|

HONG KONG, Aug. 10, 2020 /PRNewswire/ -- The Manulife group of companies operating in Hong Kong ("Manulife Hong Kong") today announced positive financial results for the second quarter and first half of 2020. Despite the challenges of COVID-19 pandemic, Manulife Hong Kong delivered solid results, marking its ongoing strong business resilience and commitment to its ambitious growth agenda.

"We have delivered very solid business performance in the first half of 2020, with consistent growth year-on-year in APE sales for seven years consecutively," said Damien Green, Chief Executive Officer of Manulife Hong Kong and Macau. "It not only shows the great diversity and underlying strength of our businesses, but also demonstrates our unwavering focus to help our customers navigate the challenges they face in light of the COVID-19 pandemic. We have leveraged the strength and agility of our agency force to better serve customer needs during this unprecedented period. In particular, we had a very strong close in the month of June with a rebound in insurance sales, reflecting the continued demand for health and retirement products. We remain committed to driving our digital capabilities and are actively looking for opportunities to drive strategic initiatives that can benefit customers in Hong Kong, Macau and the Greater Bay Area."

Results overview:

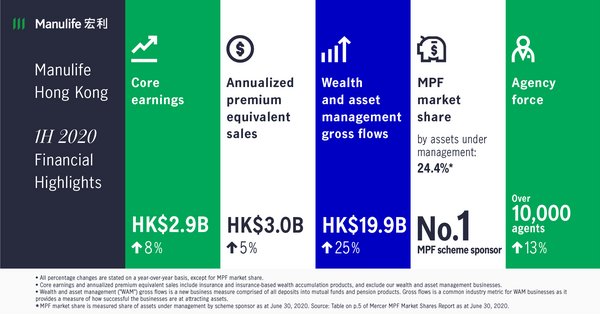

Core earnings in the first half of 2020 increased by 8% to HK$2.9 billion from HK$2.7 billion in the same period last year. Second-quarter core earnings were HK$1.4 billion, up 5% from HK$1.4 billion from the previous year quarter. The positive results were driven by a more favourable product sales mix and claims experience, as well as in-force business growth.

First-half APE sales were HK$3.0 billion, up 5% from HK$2.9 billion in the same period of 2019, primarily driven by strong product sales, further expansion of distribution capabilities and improved agency productivity. Tax-deductible solutions and medical products remained key growth drivers of the company's first-half APE sales, with almost one quarter of the APE sales attributable to Voluntary Health Insurance Scheme (VHIS) and Qualifying Deferred Annuity Policy (QDAP) products. The APE sales of VHIS products alone accounted for 59% of new business APE sales of Manulife Hong Kong's medical insurance products.

Second-quarter APE sales dipped 8% year-on-year to HK$1.4 billion. The decrease in sales to mainland Chinese visitors to Hong Kong as a result of COVID-19 travel restrictions was partially offset by an increase in demand from local customers. Manulife Hong Kong recorded a notable 19% year-on-year growth in June 2020 driven by higher agency productivity, a wide product range and marketing efforts to meet customers' needs. Excluding sales to mainland Chinese visitors, second-quarter APE sales would have grown by 14%.

In the first half of 2020, NBV grew 4% to HK$1.7 billion from HK$1.7 billion in the prior year period, due to strong sales of VHIS and QDAP products in the first quarter. In the second quarter, NBV dropped to HK$0.8 billion, down 13% from HK$0.9 billion from the previous year quarter, due to lower sales and lower interest rates.

WAM gross flows in the first half of 2020 increased to HK$19.9 billion, up 25% from HK$16.0 billion in the same period of the prior year. Second-quarter WAM gross flows decreased 4% to HK$8.2 billion, down from HK$8.6 billion in the second quarter of last year. The gross flow increase in the first half was mainly driven by strong growth of pension and mutual fund gross flows in the first quarter, where some large pension cases were recorded. However, it was partially offset by lower mutual fund sales in the second quarter due to the COVID-19 pandemic and weaker market sentiment.

During the first half of 2020, Manulife Hong Kong enhanced its digital capabilities and remote purchase arrangements to help customers obtain appropriate protection, overcoming the constraints associated with social distancing. Manulife Hong Kong was the first insurer in the city to make available a virtual face-to-face sales platform for its agency force in June 2020. This online platform enables customers to purchase the entire range of Manulife's individual insurance products other than Investment-linked Assurance Scheme.

When the COVID-19 outbreak started earlier this year, Manulife Hong Kong was among the city's first insurers to offer a host of tailored protections and caring measures, such as additional coverage and benefits, extended premium grace periods and waiting period waivers to speed up claims. In July, as local cases of the pandemic surged, Manulife announced the extension of those measures until the end of August 2020.

Despite all the challenges, product innovation continued at Manulife Hong Kong during the first half of the year. In the first quarter, Manulife's VHIS portfolio added the Manulife Supreme VHIS Flexi Plan, which offers full coverage for major medical expenses, including psychiatric treatment. In April, the company launched two savings plans – La Vie 2 and ManuCentury – to help customers build wealth and plan their legacies.

Notes: |

i. Manulife Hong Kong includes all our Hong Kong businesses including insurance, insurance-based wealth accumulation products, and our wealth and asset management businesses. |

ii. All percentage changes are stated on a year-over-year basis, except for MPF market share. |

iii. Core earnings for Manulife Hong Kong include insurance and insurance-based wealth accumulation products, and exclude our wealth and asset management businesses. Core earnings is a non-GAAP profitability measure. For full definition of core earnings, see "Performance and Non-GAAP Measures" in Manulife Financial Corporation's 2Q20 Management's Discussion and Analysis. |

iv. Annualized premium equivalent ("APE") sales are presented to provide consistency of scope for NBV disclosures and industry practice. APE sales consist of insurance and insurance-based wealth accumulation products, and exclude our wealth and asset management businesses. They comprise 100% of regular premiums/deposits sales and 10% of single premiums/deposits sales. |

v. New business value ("NBV") is the change in embedded value as a result of sales in the reporting period. NBV is calculated as the present value of shareholders' interests in expected future distributable earnings, after the cost of capital, on actual new business sold in the period using assumptions that are consistent with the assumptions used in the calculation of embedded value. NBV excludes businesses with immaterial insurance risks, such as Hong Kong's wealth and asset management businesses. NBV is a useful metric to evaluate the value created by Manulife Hong Kong's new business franchise. |

vi. Wealth and asset management ("WAM") gross flows is a new business measure comprised of all deposits into mutual funds and pension products. Gross flows is a common industry metric for WAM businesses as it provides a measure of how successful the businesses are at attracting assets. |

vii. MPF market share is measured by share of assets under management and estimated net cash flows by scheme sponsor. Source: Table on p. 5 of Mercer MPF Market Shares Report as at June 30, 2020. |

About Manulife Hong Kong

Manulife Hong Kong, through Manulife International Holdings Limited, owns Manulife (International) Limited, Manulife Investment Management (Hong Kong) Limited and Manulife Provident Funds Trust Company Limited. As a member of the Manulife group of companies, Manulife Hong Kong offers a diverse range of protection and wealth products and services to individual and corporate customers in Hong Kong and Macau.

About Manulife

Manulife Financial Corporation is a leading international financial services group that helps people make their decisions easier and lives better. With our global headquarters in Toronto, Canada, we operate as Manulife across our offices in Canada, Asia, and Europe, and primarily as John Hancock in the United States. We provide financial advice, insurance, and wealth and asset management solutions for individuals, groups and institutions. At the end of 2019, we had more than 35,000 employees, over 98,000 agents, and thousands of distribution partners, serving almost 30 million customers. As of June 30, 2020, we had C$1.2 trillion (HK$6.8 trillion) in assets under management and administration, and in the previous 12 months we made C$30.6 billion in payments to our customers. Our principal operations are in Asia, Canada and the United States where we have served customers for more than 155 years. We trade as 'MFC' on the Toronto, New York, and the Philippine stock exchanges and under '945' in Hong Kong.

Photo - https://photos.prnasia.com/prnh/20200810/2880629-1-b?lang=0

Logo - https://photos.prnasia.com/prnh/20200324/2759253-1LOGO?lang=0