|

HONG KONG, Nov. 12, 2020 /PRNewswire/ -- The Manulife group of companies operating in Hong Kong ("Manulife Hong Kong") today announced financial results for the third quarter and first nine months of 2020. Amid the prolonged COVID-19 pandemic, Manulife Hong Kong delivered double-digit growth in core earnings for both periods over the corresponding periods last year, underscoring its business resilience and strong agency distribution capabilities.

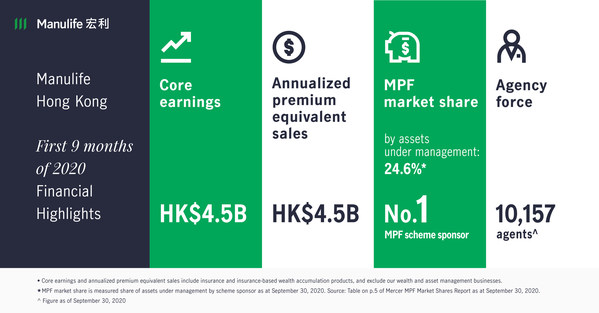

Manulife Hong Kong reports solid core earnings growth for third quarter and first nine months of 2020

Damien Green, CEO of Manulife Hong Kong and Macau, said, "We are pleased to report core earnings growth this quarter for the 13th consecutive quarter, despite the economic slowdown in Hong Kong during the third wave of the pandemic particularly in July and August. As the situation stabilized in September and social distancing measures gradually relaxed, we saw our sales momentum quickly pick up. The resilient local market demand for protection and retirement products, supported by our customer offers, helped boost our insurance business in September."

"While the pandemic continued to pose a challenge to our business, our very strong agency force in Hong Kong and Macau demonstrated remarkable resilience and robustness, recording quarter-on-quarter growth and contributing 73% of total APE sales this quarter. With a record-high number of agents and strong sales activities, third-quarter agency APE sales grew 16% over the previous quarter. Compared to the same period last year, year-to-date agency APE sales were down only 1% and year-to-date agency-driven Mandatory Provident Fund ("MPF") sales rose by 34%. This is a testament to the growing strength of our proprietary agency distribution capabilities. As part of our key business strategies, we will stay active in agency recruitment with a long-term goal of double-digit growth in annual headcount," added Mr. Green.

Results overview:

Year-to-date core earnings rose 10% to HK$4.5 billion in 2020 from HK$4.2 billion in the same period last year. Third-quarter 2020 core earnings hit a new quarterly high of HK$1.6 billion, up 15% from HK$1.5 billion in the third quarter of 2019. The solid growth in third-quarter core earnings was attributable to a more favourable new business product mix and in-force business growth.

Year-to-date APE sales were HK$4.5 billion in 2020, down 8% from HK$4.9 billion in the same period last year. Third-quarter 2020 APE sales decreased 26% to HK$1.5 billion from HK$2.1 billion in the third quarter of 2019. The third-quarter sales decline was driven by the impact of COVID-19, a decrease in sales to mainland Chinese visitors, as well as strong prior-year sales of Voluntary Health Insurance Scheme ("VHIS") and Qualifying Deferred Annuity Policy ("QDAP") products.

Year-to-date NBV was HK$2.6 billion in 2020, down 13% from HK$3.0 billion in the same period last year. Third-quarter 2020 NBV of HK$0.9 billion decreased 35% from HK$1.3 billion in the third quarter of 2019, due to lower sales volume during the pandemic and continued low interest rate environment.

Year-to-date WAM gross flows in 2020 rose 11% to HK$29.5 billion from HK$26.8 billion in the same period last year, as pension fund sales continued to grow. Third-quarter 2020 WAM gross flows were HK$9.6 billion, down 10% from HK$10.7 billion in the third quarter of 2019. The decline was driven by a significant drop in mutual fund sales resulting from weak market sentiment and the economic slowdown, partially offset by moderate growth in pension fund sales.

In the third quarter, Manulife Hong Kong spearheaded initiatives to meet the protection needs of the local population. Health and retirement offerings were strengthened with a new flagship critical illness product, ManuBright Care 2 series, and Hong Kong's first retirement income fund in the MPF market. In view of the COVID-19 pandemic, Manulife Hong Kong extended its comprehensive suite of special protection and coverage for customers to the end of September 2020. In addition, a series of successful customer campaigns offered premium discounts to encourage people to buy protection and wealth products.

About Manulife Hong Kong

Manulife Hong Kong, through Manulife International Holdings Limited, owns Manulife (International) Limited, Manulife Investment Management (Hong Kong) Limited and Manulife Provident Funds Trust Company Limited. As a member of the Manulife group of companies, Manulife Hong Kong offers a diverse range of protection and wealth products and services to individual and corporate customers in Hong Kong and Macau.

About Manulife

Manulife Financial Corporation is a leading international financial services group that helps people make their decisions easier and lives better. With our global headquarters in Toronto, Canada, we operate as Manulife across our offices in Canada, Asia, and Europe, and primarily as John Hancock in the United States. We provide financial advice, insurance, and wealth and asset management solutions for individuals, groups and institutions. At the end of 2019, we had more than 35,000 employees, over 98,000 agents, and thousands of distribution partners, serving almost 30 million customers. As of September 30, 2020, we had C$1.3 trillion (HK$7.5 trillion) in assets under management and administration, and in the previous 12 months we made $31.2 billion in payments to our customers. Our principal operations are in Asia, Canada and the United States where we have served customers for more than 155 years. We trade as 'MFC' on the Toronto, New York, and the Philippine stock exchanges and under '945' in Hong Kong.

Notes: