SINGAPORE, April 1, 2024 /PRNewswire/ -- Mortgage Master, Asia's one-stop mortgage brokering platform, today announced the launch of its new mortgage loan app, Mortgage Master SG, designed to provide simplicity and speed for first-time homeowners and those seeking new loans for property purchases.

A lack of transparent and consolidated information in interest rates means that on average, a homeowner conducts 12 hours on research and paperwork, assessing at least 15 banks – with each touting the 'best' offering, but often still ends up with buyer's remorse. In addition, homeowners in Singapore typically overpay their mortgages by 0.5 to 1 percent.

Addressing Current Challenges Homebuyers Face in Singapore

As a banker, David Baey, CEO of Mortgage Master, has seen many homeowners stretching their finances in order to pay off their mortgages. This usually stems from poor financial planning in the beginning, with most choosing to max out their bank loans in order to afford the homes they need. Typically these can be avoided with the right advice from an experienced mortgage banker.

Mortgage Master's app aims to solve this by serving as a personalised Property Mortgage Consultant. With the app, homebuyers can get the right advice for a comfortable home ownership journey.

Instant IPA (In-Principle Approval)

With the current heated property market, homeowners looking to buy often find themselves not being able to make an offer fast enough, especially with the current average approval time of three to seven business days for in-principle loan approval. Recognising this, Mortgage Master's app features an Instant In-Principle Approval (IPA) tool that is integrated with Singpass, to provide consumers with an accurate loan amount based on their income, thus offering them clarity on the type of home they can purchase.

This tool provides users with a quick one day turnaround estimate of the loan amount banks are likely to approve based on their income. Integrated with Singpass for accuracy, it offers a quick and clear picture of the kind of home users can afford, enabling confident property offers.

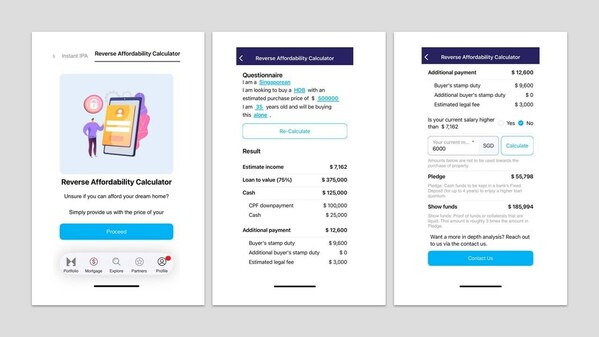

Reverse Affordability Calculator

Aspiring homeowners often find their choices restricted by affordability restrictions. In response, Mortgage Master's app will provide tailored affordability options and insights on how homeowners can maximise purchasing power. One of the app's main features is the Reverse Affordability Calculator, which shows users how to maximise their spending power.

By keying in details such as property type and income, the app will reveal the required income and down payment, and provide insights on how users can close the gap between their present affordability and their desired property. This comprehensive solution aims to expand buyers' horizons, allowing them to maximise their purchasing power and explore a diverse array of properties that align with their aspirations.

Photo: Screenshots of the Reverse Affordability Calculator displaying an example of the necessary payment required for a homeowner’s mortgage and how Mortgage Master can help close the gap between current affordability and a homeowner’s dream home.

"We are incredibly excited to launch this app and expand our reach to support more homeowners as they embark on their journey to securing their dream home," said David Baey, Co-Founder and Chief Executive Officer, Mortgage Master. "Buying a home is arguably the most expensive purchase you will make in your lifetime and can be the cause of huge financial and mental stress. We want to simplify this process for homeowners by removing the guesswork and relieving them from the burden of financial uncertainty. Everyone deserves a personalised and hassle-free mortgage experience, and our app is designed to act like your best personal assistant by offering homeowners access to the best mortgage loans available to them anytime."

Property Master SG is now available for download on iOS and Android.

About Mortgage Master

Mortgage Master is Asia's one-stop mortgage brokering platform for homeowners to find the best mortgage rates tailored to their needs. Founded in 2018 by former bankers who finally decided it was time to stop selling only one bank's home loan product at a time, Mortgage Master is a neutral platform that partners with all banks and empowers them to behave the way they should – in homeowners' best interests.

Driven by a team with extensive leadership, technology and sales expertise in corporate finance, personal finance, mortgage-related industries and FinTech innovation, Mortgage Master has transacted more than SG$800 million in home loans and delivered unbiased advice for SG$4 billion in mortgages since its launch. Committed to always doing right by the customer, Mortgage Master has advised more than 8,000 homeowners and saved them SG$100 million per year in home loan interest repayments.