|

BANGKOK, March 2, 2020 /PRNewswire/ -- A new study by management consultancy Roland Berger confirms that banks in Thailand are facing deteriorating market structure, which sees intensifying competition, commoditization of services, shrinking of some fee revenues, and potentially increasing Non-Performing Loans (NPL). In the next 5 years, Roland Berger predicts a lot of headwind in Thailand banking market, which will put profitability metrics under duress.

"In the coming years, banks are less at risk of losing out to new digital disruptors and entrants than they are of eroding revenues and profit due to insufficient adjustments in their operational model and cost structure. Declining profitability will likely influence senior management's decision to undergo further cost structure adjustment in the banking sector," says Dr. Udomkiat Bunworasate who is a Partner at Roland Berger and co-author of the research.

The Roland Berger whitepaper, titled "How can Thai banks bridge the profitability gap while waiting for the digital dividend", asserts that Thai commercial banks will be hard-pressed to preserve the current average Return on Equity (ROE) of 8% like previous years with profitability of the entire banking sector at risk of dropping to average ROE value of around 6.6% over the next 3 years.

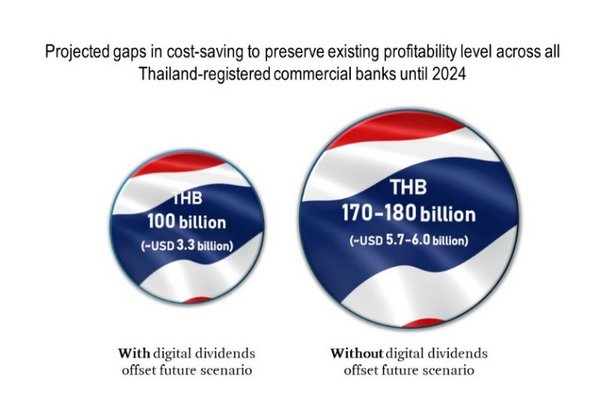

Dr. Bunworasate advises Thai banks to rely on proven short-term cost containment initiatives to weather the next 3 to 5 years while banks reassess their portfolio of digital investments. Ultimately, the study estimated that between THB 100 billion (~USD 3.3 billion) and THB 180 billions (~USD 5.7-6.0 billion) of cost-saving would be needed in the next 5 year to fight ROE erosion in the Thai banking sector.

Decoding the slowdown of recent years

For a majority of the past two decades, Thailand economy has enjoyed a steady recovery from 1997 Asian Financial Crisis and entered a reconstructive period marked by a high growth rate of 8.0% per year in commercial banks' assets up until 2013. More recently, the growth of the banking sector has slowed, averaging a weak 3.7% in annual growth between 2013 and 2019. Around this period, many Thai commercial banks launched broad-based transformation program to sustain top-line growth and increase efficiency.

There has since been an explosion of digital transformation programs in banking sector -- spanning from robo-advisor pilot initiatives, customer service chatbots, revamped mobile banking experience, IT cloud adoption, to online credit assessment for lending. The combination of these digital programs has put a significant investment burden on banks that is estimated to last several years before projected dividends materialize.

"In practice, adjustment to cost structures are needed in the short term as banks are in the middle of a difficult journey. This momentum can be amended but should not be stopped entirely. Banks still have to go through what we call the 'Valley of No Return' until the digital dividend pays off. This will most likely be a longer-than-expected walk," says Mr. Philippe Chassat, Senior Partner at Roland Berger and a co-author of the research.

Tightening the ship to mitigate banking profitability decline in Thailand

To prevent deteriorating profitability across banking sector, Roland Berger estimates that Thai banks are required to produce approximately THB 100 billion (~USD 3.3 billion) of cost-saving from now until 2024. As illustrated, its projection model estimated that a cost-saving of THB 170-180 billion (~USD 5.7-6.0 billion) is needed in the worst-case future scenario.

Roland Berger's research also recommends for three complementary and well-proven approaches to be considered by banks in performing their cost adjustment, namely Accelerated Zero-based Budgeting, Procurement Excellence, and IT Frugality.

Mr. Chassat asserts that a lot of work will be needed for Thai banks to transition and adjust to the new structural realities of the market. He suggested that banks should take proactive steps now to be in a better position to benefit from the next economic uptick and enjoy the positive mid-to-long term growth perspective of the sector in the region.

The study can be downloaded here:

https://www.rolandberger.com/en/Publications/Thailand-Banking-Market-How-to-bridge-the-profitability-gap.html

Roland Berger, founded in 1967, is the only leading global consultancy of German heritage and European origin. With 2,400 employees working from 34 countries, we have successful operations in all major international markets. Our 52 offices are located in the key global business hubs. The consultancy is an independent partnership owned exclusively by 230 Partners.

Photo - https://photos.prnasia.com/prnh/20200302/2734925-1?lang=0

Logo - https://photos.prnasia.com/prnh/20200302/2734925-1LOGO?lang=0