|

VANCOUVER, BC, Oct. 12, 2022 /PRNewswire/ -- Regency Silver Corp. ("Regency Silver" or the "Company") (TSXV: RSMX) (OTCQB: RSMXF) is pleased to announce that its initial drill hole into a pronounced Induced Polarization (IP) anomaly 500 m north of the historic Dios Padre silver mine workings intercepted 4.7 g/t gold over 53.8 metres. The intercept included 35.8 metres of 6.84 g/t gold, 0.88% copper and 21.82 g/t silver, starting at 420 m depth down hole along with 13.97 g/t Au, 50.25 g/t Ag and 1.11 % Cu over 9.8 m starting at 460.5m down hole. The hole ended in mineralization and was stopped due to the 500 metre maximum capacity of the drill rig being used.

The goal of the drill campaign at the Dios Padre project was two-fold. To test the core of the IP anomaly 500 m to the north of the old mine workings and to expand the Dios Padre silver mine mineralization both to the east and to the west. The drill program was successful on both fronts, intersecting strong gold, copper and silver mineralization in the core of the IP anomaly as well as successfully intersecting silver and gold mineralization both to the east and west of the old mine workings.

Gold-Copper-Silver mineralization in REG-22-01 is largely breccia hosted, with sulphides (pyrite, chalcopyrite) forming the breccia matrix. The core of the mineralized zone sits within and adjacent to a felsic intrusive body, though mineralization is present both within the felsic unit as well as the host andesites. Both rock units are strongly altered to white mica with some silica. Gold and copper values correlate well with increased sulphide abundance, and coarse visible gold (VG) was found in some of the more gold-rich areas. The current hypothesis is that this zone represents a down-dip extension of the Dios Padre silver mine where we have moved further up the temperature gradient of the system from a Ag-Pb-Zn dominant assemblage in the old mine workings, to a Au-Cu dominant assemblage down-dip. The current hypothesis is that this mineralization is driven by magmatic fluids and that the mineralization intersected in REG-22-01 represents a step closer to the magmatic source. Work is ongoing to determine more specifically what type of broad, mineralizing system is present at Dios Padre. Regency is highly encouraged by what these results indicate.

Additional drilling outside of the existing block model near the old silver mine workings intercepted grades as high as 582.47 g/t silver over 3.9 m from 21.1 m to 25 m depth in hole REG-22-05, 558.30 g/t silver over 5.85 m from 38.15 m to 44 m in hole REG-22-06 and 420.23 g/t silver over 3.10 m in hole REG-22-09. The old silver mine workings contain an existing NI 43-101 inferred resource of 9.5 million ounces of silver equivalent with an average silver grade of 236 g/t.(1.25 million tonnes at a grade of 236 g/t Ag Eq ). Regency is very encouraged that the step-outs all indicate that the system continues both to the east and the west where it was previously thought to have stopped and currently sees no impediment to continued lateral expansion of the deposit along strike to the east and the west. Additionally, to the east, gold values of the easternmost holes are some of the strongest intersected in the mine area with hole REG-22-04 intersecting 17.9 m of 1.34 g/t Au. The results indicate a more gold rich zonation in the system towards the east.

Regency plans to follow up this successful program with a more thorough airborne and ground geophysical program in addition to further drilling to expand on the exceptional results from REG-22-01. Work is ongoing to secure a drill and contractor with a deeper drilling capacity to determine the extent of the mineralization below 500 m downhole depth.

Bruce Bragagnolo, Executive Chairman said "The 2022 drill program was a major success. The drill hole into the prominent IP anomaly proved out our theory that the mineralization at depth would be different than the silver mineralization found at the historic Dios Padre silver mine workings. The gold and copper grades below the IP anomaly have proven to be at the very top range of our expectations. The drill results outside of the block model at the historic silver mine workings were also very promising and justify additional work. Our upcoming programs will be designed to verify management's model of a large, district scale magmatic-hydrothermal gold-copper-silver system."

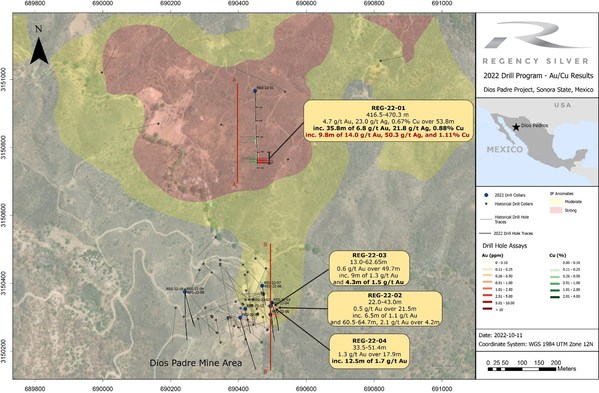

Figure 1. Plan Map showing all Regency drilling and new 2022 assay results for gold (red) and copper (green). Background is the IP anomaly which extends over 1 km. Highlights for the best gold intersections are labelled on the map.

Figure 2. Plan Map showing all Regency drilling and new 2022 assay results for gold (red) and silver (blue). Background is the IP anomaly which extends over 1 km. Highlights for the best silver intersections are labelled on the map.

Figure 3. Cross section of REG-22-01 with chargeability anomaly in background and highlighted composites.

Figure 4. Cross-section for holes REG-22-02-REG-22-07. Both gold and silver results are shown on the histograms with the best intersections labelled on the section.

Figure 5. Thick cross-section through both REG-22-01 and holes REG-22-02-REG-22-07. The large chargeability anomaly is shown as well as the block model for the Dios Padre silver deposit (NI 43-101 inferred resource of 9.5 million ounces of silver equivalent with an average silver grade of 236 g/t. ((1.25 million tonnes at a grade of 236 g/t Ag Eq).

Figure 6. Drill core assay values from REG 22-01 between 459.5 m to 468.5 m.

Table 1: REG-22-01 Weighted composite table for Au, Ag and Cu for highlight intersection. |

||||||

Hole |

From (m) |

To (m) |

Length (m) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

REG-22-01 |

416.5 |

470.3 |

53.8 |

4.7 |

23.9 |

0.67 |

inc. |

434.5 |

470.3 |

35.8 |

6.84 |

21.81 |

0.88 |

inc. |

448.7 |

454.7 |

6 |

8.3 |

12.56 |

0.87 |

inc. |

460.5 |

470.3 |

9.8 |

13.97 |

50.25 |

1.11 |

1. |

Au Composites are calculated using a 0.3 g/t Au cutoff, incorporating no more than 5 m downhole dilution. Higher grade composite sections are calculated using 1 g/t and 3g/t cutoffs incorporating no more than 5 m downhole dilution. Ag and Cu composites for these intervals are snapped to those intervals bearing the strongest Au values, they represent the average Ag and Cu values within the same stated gold intervals and do not necessarily conform to the composite rules for Ag and Cu stated in point 3 below Table 4. |

Table 2: Weighted Cu composites for total 2022 drill program for all significant Cu intersections. |

||||

Hole |

From (m) |

To (m) |

Length (m) |

Cu (%) |

REG-22-01 |

281.5 |

341.5 |

60 |

0.33 |

inc. |

284.5 |

324.6 |

40.1 |

0.38 |

REG-22-01 |

398.5 |

404.5 |

6 |

0.23 |

REG-22-01 |

416.5 |

468.5 |

52 |

0.69 |

inc. |

434.5 |

467.5 |

33 |

0.94 |

inc. |

460.5 |

466.5 |

6 |

1.62 |

Table 3: Weighted Au composites for total 2022 drill program for all significant Au intersections. |

||||

Hole |

From (m) |

To (m) |

Length (m) |

Au (g/t) |

REG-22-01 |

187.95 |

191.5 |

3.55 |

0.36 |

REG-22-01 |

300.7 |

330 |

29.3 |

0.36 |

REG-22-01 |

398.5 |

404.5 |

6 |

0.68 |

REG-22-01 |

416.5 |

470.3 |

53.8 |

4.7 |

inc. |

434.5 |

470.3 |

35.8 |

6.84 |

inc. |

448.7 |

454.7 |

6 |

8.3 |

inc. |

460.5 |

470.3 |

9.8 |

13.97 |

inc. |

460.5 |

468.5 |

8 |

15.35 |

REG-22-02 |

22 |

43.5 |

21.5 |

0.53 |

inc. |

37 |

43.5 |

6.5 |

1.1 |

REG-22-02 |

60.5 |

64.7 |

4.2 |

2.1 |

REG-22-03 |

13 |

62.65 |

49.65 |

0.58 |

inc. |

32.5 |

41.5 |

9 |

1.3 |

inc. |

53.5 |

57.8 |

4.3 |

1.49 |

REG-22-03 |

73.5 |

83.5 |

10 |

0.57 |

REG-22-04 |

12.5 |

24.2 |

11.7 |

0.23 |

REG-22-04 |

33.5 |

51.4 |

17.9 |

1.34 |

inc. |

37 |

49.5 |

12.5 |

1.66 |

REG-22-12 |

10 |

28 |

18 |

0.12 |

REG-22-12 |

62.85 |

86.5 |

23.65 |

0.36 |

Table 4: Weighted Ag composites for total 2022 drill program for all significant Ag intersections. |

||||

Hole |

From (m) |

To (m) |

Length (m) |

Ag (g/t) |

REG-22-01 |

242.5 |

268.8 |

26.3 |

62.68 |

inc |

242.5 |

259 |

16.5 |

96 |

inc |

250.1 |

254.4 |

4.3 |

317.4 |

REG-22-01 |

281.5 |

341.5 |

60 |

19.25 |

inc. |

281.5 |

293.5 |

12 |

31.01 |

inc. |

300.7 |

314.5 |

13.8 |

25.88 |

inc. |

328.5 |

338.5 |

10 |

19.45 |

REG-22-01 |

418.5 |

426.5 |

8 |

60.08 |

REG-22-01 |

434.5 |

452.5 |

18 |

14.35 |

REG-22-01 |

460.5 |

468.5 |

8 |

67.06 |

inc. |

460.5 |

464.5 |

4 |

105.88 |

REG-22-02 |

17.5 |

32.35 |

14.85 |

23.63 |

REG-22-04 |

48.5 |

60.5 |

12 |

45.01 |

inc. |

49.5 |

52.05 |

2.55 |

186.37 |

REG-22-05 |

15.1 |

32.6 |

17.5 |

135.07 |

inc. |

21.1 |

25 |

3.9 |

582.47 |

REG-22-05 |

52.2 |

54.4 |

2.2 |

220.49 |

REG-22-06 |

38.15 |

49.1 |

10.95 |

301.83 |

inc |

38.15 |

44 |

5.85 |

558.3 |

REG-22-07 |

39.95 |

46 |

6.05 |

335.7 |

REG-22-08 |

96.45 |

115 |

18.55 |

49.61 |

inc. |

101.5 |

109 |

7.5 |

113.01 |

REG-22-08 |

121.45 |

133 |

11.55 |

30.63 |

REG-22-09 |

99.4 |

102.5 |

3.1 |

420.23 |

REG-22-10 |

112.5 |

134 |

21.5 |

137.37 |

inc. |

112.5 |

126.6 |

14.1 |

206.3 |

REG-22-11 |

0 |

4 |

4 |

54.31 |

REG-22-11 |

32.5 |

57.8 |

25.3 |

27.56 |

inc. |

44.5 |

54.1 |

9.6 |

56.43 |

REG-22-11 |

81.5 |

82.5 |

1 |

603 |

REG-22-12 |

10 |

53.5 |

43.5 |

44.39 |

inc. |

10 |

22 |

12 |

115.55 |

REG-22-12 |

64.1 |

101.5 |

37.4 |

109.98 |

inc. |

64.1 |

83.75 |

19.65 |

203.38 |

inc. |

64.1 |

79 |

14.9 |

240.68 |

1. |

Regency Silver is not yet able to determine true width of the mineralized zones due to the limited number of intersections at this stage however, all drill holes were planned to cross known stratigraphy and it is estimated that zones intersected are somewhere between 50-100% true thickness. Reported widths are drill indicated core length and not true width, for the reasons above. Average grades are calculated with un-capped assays, as insufficient drilling has been completed to determine capping levels for higher grade gold, silver and copper intercepts. |

2. |

Au Composites are calculated using a 0.3 g/t Au cutoff, incorporating no more than 5 m downhole dilution. Higher grade composite sections are calculated using 1 g/t and 3 g/t cutoffs incorporating no more than 5 m downhole dilution. Ag composites are calculated using a 10 g/t Ag cutoff, incorporating no more than 5 m downhole dilution. Higher grade composite sections are calculated using 25 g/t and 50 g/t cutoffs incorporating no more than 5 m downhole dilution. Cu composites are calculated using a 0.1% Cu cutoff, incorporating no more than 5 m downhole dilution. Higher grade composite sections are calculated using 0.5% Cu and 0.75% Cu cutoffs incorporating no more than 5 m downhole dilution. |

QA/QC

Once the drill core was received from the drill site, individual samples were determined, logged for geological attributes, sawn in half, labelled, and bagged for assay submittal. The remaining drill core was then stored at a secure site in the buildings surrounding the old milling site for the Dios Padre silver mine. The Company inserted quality control samples at regular intervals within the sample stream which included blanks, preparation duplicates, and standard reference materials with all sample shipments intended to monitor laboratory performance. Sample shipment was conducted under a chain of custody procedure.

Drill core samples were submitted to ALS Global's analytical facility in Hermosillo, Mexico for preparation and analysis. Sample preparation included drying and weighing the samples, crushing the entire sample, and pulverizing 250 grams ("g"). Analysis for gold was by method Au-AA23: 30g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.005 ppm and upper limit of 10 ppm. Gold assays greater than 10ppm are automatically analyzed by method Au-GRA21: 30g fire assay fusion with a gravimetric fusion. Analysis for silver and base metals was by method ME-ICP61m: 0.75 g is dissolved via four acid digest and analyzed with ICP-AES finish. Detection limits for Ag are 0.5-100ppm, 1-10 000ppm for Cu, 2-10 000ppm for Zn and 2-10 000ppm for Pb. Silver assays greater than 100ppm are automatically analyzed by method Ag-OG62: 0.4g sample by Ag by HF-HNO3-HClO4 digestion with HCl leach, ICP-AES or AAS finish. Samples with Ag>1500ppm are automatically analyzed by Ag-GRA21: 30g sample Ag by fire assay and gravimetric finish. Cu, Pb and Zn >10 000ppm are automatically analyzed by Cu-OG62, Pb-OG62 and Zn-OG62 respectively: 0.4g sample by Four acid digestion and ICP finish.

ALS Global is ISO 9001 and ISO/IEC 17025 certified and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. Parameters for ALS' internal and Regency Silver's external blind quality control samples were acceptable for the analyzes returned.

Technical Information

The technical information contained in this news release has been reviewed by Company director Michael Tucker, P.Geo, who is recognized as a Qualified Person under the guidelines of National Instrument 43-101. Mr. Tucker is a director of the Company and for that reason is not considered independent. Mr. Tucker has read and approved the technical contents of this news release.

For further details about the Company please visit the Company's new website at www.Regency-Silver.com.

Contact Information

Regency Silver Corp.

Bruce Bragagnolo, Executive Chairman

Phone: (604) 417-9517

Email: bruce@regency-silver.com

Gijsbert Groenewegen, Chief Executive Officer

Phone: 1-646-247-1000

Email: gijs@regency-silver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ABOUT REGENCY SILVER CORP.

Regency Silver is a gold-copper-silver exploration company focused on the Americas. Regency Silver is led by a team of experienced professionals with expertise in both exploration and production. Regency Silver's flagship project is the Dios Padre gold-copper-silver project in Sonora, Mexico.

Information Concerning Estimates of Mineral Resources

The scientific and technical information in this news release was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). The terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" used herein are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the "CIM Definition Standards"), which definitions have been adopted by NI 43-101. Accordingly, information contained herein providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

You are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Information regarding mineral resources contained or referenced herein may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be "substantially similar" to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral resources that the Company may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

Cautionary Note Regarding Forward-Looking Statements: This news release includes certain forward-looking statements and forward-looking information (together, "forward-looking statements"). All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the optioning of the Project by the Company. There can be no assurance that such statements will prove to be accurate and actual results and future events may vary from those anticipated in such statements. Important risk factors that could cause actual results to differ materially from the Company's plans or expectations include the risk that regulatory changes, fundraising, and risk associated with mineral exploration, including the risk that actual results of exploration will be different from those expected by management. The forward-looking statements in this news release were developed based on the expectations of management, including that Exchange acceptance for the proposed transaction will be obtained, conditions will be satisfied, required fundraising will be completed and the other risks described above will not materialize. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by applicable securities legislation.