TOKYO, May 14, 2021 /PRNewswire/ -- Toshiba Corporation (President and CEO, Satoshi Tsunakawa, hereinafter "Toshiba") and Dharma Capital. K.K. (Founder and CEO, Akiyoshi Shiotani, hereinafter "Dharma Capital") will launch a joint project to verify the effectiveness of high frequency trading (hereinafter "HFT") strategies for the Japanese listed stocks based on optimal solutions presented by a quasi-quantum computer, Toshiba's Simulated Bifurcation Machine™. This is the world's first attempt*1 to verify the effectiveness of quasi-quantum computers when they are applied to the HFT strategies in actual financial trading systems.

Logo

Logo

Realizing financial markets in which all investors can trade at fair values requires improvements in market efficiency*2 and liquidity*3. High frequency traders, who continue to become more important as trading entities in financial markets*4, are characterized by repeating buying and selling of financial products at high-speed and high-frequency using trading algorithms that enable them to make high-speed decisions. It is believed that such HFT activities contribute to improving market efficiency and liquidity*5.

For example, in the stock market, such factors as excessive responses to the news by the media can cause prices of individual stocks to deviate significantly from their fair values (hereinafter "mispricing"), which may cause investors to trade at unfavorable prices. High frequency traders have the ability to quickly eliminate these mispricings and improve market efficiency and liquidity by executing transactions that match overvalued/undervalued financial products even when markets are in such volatile situations*5.

Conventional HFTs tend to focus on self-evident arbitrage*6 opportunities where high speed is the main source of competitiveness. An integration with mathematical models that require high-precision wide-area search*7 using sophisticated evaluation functions to detect mispricings has not necessarily progressed over the years. On the other hand, in recent years, there has been rapid progress in the development of quasi-quantum computers that can solve large-scale combinatorial optimization problems at high speeds and low latency*8,9, which was previously difficult.

By combining this quasi-quantum technology with conventional HFT technology, it is now possible to search a wider area, which includes statistical arbitration opportunities that have not been targeted before, with a sufficient level of low latency against market price fluctuations. Establishing trading systems that can quickly detect ever-untargeted mispricings and eliminate them is expected to further improve market efficiency and liquidity. The arrival of quasi-quantum technology envisions the new concept of algorithmic trading, but due to the nature of finance and especially of HFT, it needs to be validated in the actual market first.

In this joint experiment, Toshiba and Dharma Capital will examine the effectiveness of HFT strategies that are feasible only with the computational power of Toshiba's Simulated Bifurcation Machine™*8 (Figure 1*9), which is a quasi-quantum computer that solves combinatorial optimization problems at the world highest speed and largest scale*8. This is the world's first attempt to verify the effectiveness of quasi-quantum computers when they are applied to HFT strategies in actual financial markets*1.

In this joint experiment, Toshiba will provide Dharma Capital with Simulated Bifurcation Machine™ customized for financial trading, with which Dharma Capital will combine its proprietary HFT technologies. Dharma Capital will engage in HFT strategies on Japanese stocks at the JPX Co-location area of the Tokyo Stock Exchange. Specifically, the two parties will construct a financial trading system environment as shown in Figure 2, and verify the effectiveness of investment strategies based on optimal solutions presented by Toshiba's Simulated Bifurcation Machine™.

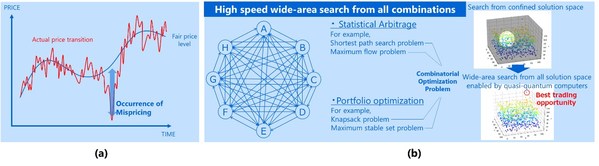

As explained earlier, Simulated Bifurcation Machine™ will be utilized to detect mispricings (Figure 3a) in a wide area. As shown in Figure 3b, it detects mispricings that can only be reached by solving combinatorial optimization problems, for example, by solving the shortest path search problem in the whole investment universe.

Figure 3: Wide-Area Search of Mispricing Using Quasi-Quantum Computers: (a) Image of Occurrence of Mispricing (b) Wide-Area Search Methods Based on Combination Optimization for Trading Strategies

As its applications in the stock market, it has been planned to conduct statistical arbitrage strategies and optimal portfolio constructions based on the fast detection of ever-untargeted mispricings by solving combinatorial optimization problems. These strategies exploiting such quasi-quantum computers are considered to conceptually differ from existing HFT strategies and are expected to find new investment opportunities that existing HFT systems are unable to target.

Combining Dharma Capital's HFT technologies with Toshiba's Simulated Bifurcation Machine™ will find undiscovered opportunities by exploring all possibilities while maintaining sufficient speed. The parties will examine the effectiveness of the investment strategies exploiting the quasi-quantum computer in the financial market, and verify its contributions to efficient price formation and liquidity improvement in the market.

This joint experiment will be conducted under the following structure:

Toshiba: Provides Toshiba's Simulated Bifurcation Machine™ customized for financial trading to Dharma Capital

Dharma Capital: Conducts high speed trading*10, using a system that combines Dharma Capital's proprietary HFT technologies and the quasi-quantum computer provided by Toshiba

The methodology examined in this experiment should apply not only to high speed trading of stocks listed on the Tokyo Stock Exchange but also to that of any other electronically-tradable financial products, such as foreign stocks, fixed income securities, commodities, and other derivative securities. Toshiba and Dharma Capital believe that understanding the undiscovered relationships amongst a vast variety of these financial products via this new methodology will lead to the discovery of unique methods of providing additional liquidity to previously illiquid financial products. We will endeavor to contribute to the stability and steady growth of financial markets with our cutting-edge technologies.

| *1 Based on examination conducted by Toshiba Corporation |

| *2 According to [Shleifer A., and R. W. Vishny, 1997, The Limits of Arbitrage, The Journal of Finance, March 1997, Vol. 52, No. 1, pp.35-55], market efficiency is achieved by arbitrage*5 whose effect is to bring prices to fundamental values. |

| *3 An index that indicates the level of ease for investors to trading stocks in the market. Market with high liquidity is where you can execute large-lot trading at any time without significantly impacting the market price. |

| *4 This refers to high speed trading defined in Article 2 Paragraph 41 of the Financial Instruments and Exchange Act of Japan. According to [1st Market Working Group by the Financial System Council of Japan, Secretariat Briefing Materials, May 2016], the ratio of the number of orders from the co-location area to all transactions on the Tokyo Stock Exchange was over 70% as of January 2016, and it is said that most of them are orders from HFT. According to [Malceniece L., K. Malcenieks, and T. J. Putnins, 2019, High frequency trading and comovement in financial markets, Journal of Financial Economics, Vol. 134, pp.381-399.], while estimates of scale of HFT activity vary depending on the market and how broadly HFT is defined, there is no doubt HFT accounts for a large share of trading volume in most developed markets. |

| *5 Brogaard J., H. Terrence, and R. Ryan, 2014, High-Frequency Trading and Price Discovery, The Review of Financial Studies, August 2014, Vol. 27, No. 8 (August 2014), pp.2267-2306. |

| *6 Arbitrage is defined by [Sharp W., and G. Alexander, 1990, Investments, 4th edition] as "the simultaneous purchase and sale of the same, or essentially similar, security in two different markets for advantageously different prices". |

| *7 In this article, "wide-area search" mean finding the best one from all candidates. Specifically, the term is referring to find the best investment opportunity by solving mathematically defined combinatorial optimization problems. |

| *8 Toshiba Press Release 1: https://www.global.toshiba/ww/technology/corporate/rdc/rd/topics/19/1904-01.html; H. Goto et al., Science Advances 5, eaav2372 (2019). https://advances.sciencemag.org/content/5/4/eaav2372 |

| Toshiba Press Release 2: https://www.global.toshiba/ww/technology/corporate/rdc/rd/topics/21/2102-01.html; H. Goto et al., Science Advances 7, eabe7953 (2021). https://advances.sciencemag.org/content/7/6/eabe7953 |

| Toshiba Press Release 3: https://www.global.toshiba/ww/technology/corporate/rdc/rd/topics/21/2103-01.html; K. Tatsumura et al., Nature Electronics 4, 208-217 (2021). https://doi.org/10.1038/s41928-021-00546-4 |

| *9 Toshiba Press Release: https://www.global.toshiba/ww/technology/corporate/rdc/rd/topics/19/1910-02.html; K. Tatsumura et al., IEEE Int'l Symp. on Circuits and Systems (ISCAS), 1-5 (2020). https://doi.org/10.1109/ISCAS45731.2020.9181114 |

| *10 As a high-speed trading operator as defined in Article 2 Paragraph 42 of the Financial Instruments and Exchange Act of Japan. |