GoWealth Digital Wealth Advisory goes into Soft Launch

HONG KONG, April 25, 2022 /PRNewswire/ -- WeLab Bank (or "the Bank"), the virtual bank dedicated to curating intelligent banking experience, has become the first virtual bank in Hong Kong licensed to offer digital wealth advisory services. Having obtained the Type 1 (Dealing in securities) and Type 4 (Advising on securities) licenses from the Hong Kong Securities and Futures Commission (HKSFC), the Bank soft launched its intelligent wealth solution GoWealth Digital Wealth Advisory (GoWealth) for selected customers, with the public launch scheduled for the near future.

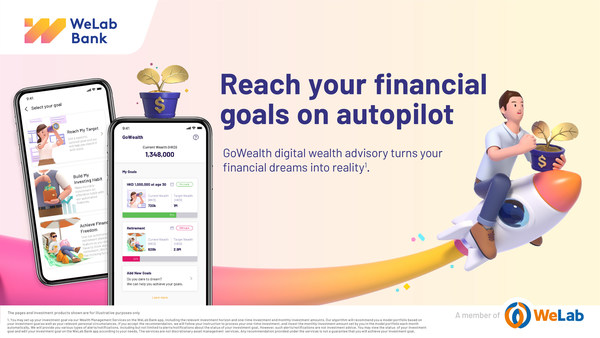

WeLab Bank is Hong Kong’s 1st virtual bank licensed to offer digital wealth advisory services; its digital wealth advisory services GoWealth has entered the soft launch stage.

First Digital Wealth Advisory Solution powered by AllianzGI's expertise

GoWealth is WeLab Bank's wealth management advisory solution which capitalizes on the investment expertise by Allianz Global Investors (AllianzGI), one of the world's leading asset management firms. The two industry pioneers announced a strategic collaboration early last year, aiming to combine their expertise in fintech and investment management, as well as their deep understanding about the financial needs and habits of Hong Kong people for the Bank to create a brand-new seamless intelligent wealth advisory experience for the city.

Set your Financial Goals. GoWealth is so intuitive, navigation will feel like "autopilot"

Unlike most of the wealth management solutions in the market which are risk-based, GoWealth will take a tailored goal-based approach to offer personalized intelligent advisory services to customers, seamlessly and intuitively through our mobile app. More details are available on the WeLab Bank website. Interested customers can now preview GoWealth's interface and get a taste of the goal-setting flow in the WeLab Bank app. Other functions, such as investment advisory, transaction and goal management, will be open to all customers at the public launch. More details of GoWealth will be unveiled closer to the public launch in the coming months.

Professor KC Chan, Chairman of WeLab Bank, believes that GoWealth will become the personalized intelligent wealth advisor at our customers' fingertips. "Although Hong Kong enjoys abundant wealth solutions options, according to the findings of a third-party survey*, only 1/3 of locals have access to professional financial advice, indicating a substantial unmet needs of wealth management in the market. In view of this, WeLab Bank has leveraged fintech to fill up the gap in wealth management market by designing a personalized intelligent wealth management advisory solution for all, assisting customers to achieve financial goals with ease."

To better understand the financial management behaviors and needs of Hong Kong people, WeLab Bank and AllianzGI have commissioned independent market research agency Nielsen to conduct an online survey, in which 1,000 respondents, aged 20-59 and with a monthly household income no less than HKD15,000, were interviewed about their goals and struggles on their financial journeys.

70% are unsure if their current financial plans would help achieve financial goals

The survey revealed that 81% of the respondents have clear financial goals. The most popular options are: to leave their jobs and spend a year on realizing dreams (33%) and to achieve financial independence before age 50 (33%). Despite having clear financial goals, more than half of them have no idea about how to achieve them.

65% don't have a clear picture of their portfolio composition and performance

The survey also found that Hong Kong people generally allocate 20% of their income to savings and investments, but 65% admitted that they are not clear about their investment portfolio composition and its performance, and are not sure whether their investment and savings are capable of achieving their financial goals. Additionally, 50% of the respondents think they need professional financial advice but have no access to it.

Saving "blindly" without clear alignment with financial goals

WeLab Bank and AllianzGI believe that many Hong Kong people are not certain whether their saving and investment portfolios are effective. However, as they have no access to professional financial advice, easy-to-use wealth management platforms or wealth management tools with transparent charges, they can only resort to risk their financial planning by saving "blindly", which may result in drifting further away from their financial goals.

Philip Tso, Head of Institutional Business for Asia Pacific at AllianzGI, suggests that Hong Kong people should begin with a practical financial goal, then achieve it through a systematic approach. "The momentum of saving and investment is significantly affected by the achievability of the financial goals. People should take a goal-based approach, breaking down a big goal into several smaller, easier goals. With persistence, everyone can build up a powerful habit of saving and investment, and achieve bigger goals step by step."

Tso also points out that goal-based digital wealth advisory solutions are in great demand in Hong Kong, according to the survey results*. This demand led WeLab Bank to team up with AllianzGI's expertise in digital investment solutions, to help tackle the pain points of Hong Kong people and assist them to achieve their financial goals through GoWealth. Tso added, "We are excited to collaborate with WeLab Bank to launch GoWealth, enabling agility and predictability in wealth management through digital-led asset allocation and monitoring."

For more details about digital wealth advisory services GoWealth, please refer to the WeLab Bank website and stay tuned for further announcements.

*Based on the results of the online questionnaire survey conducted by Nielsen. Please refer to the body text of this press release for details. |

Disclaimer: The above information is for reference only and does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. The investment products or services are not equivalent to, nor should it be treated as a substitute for, time deposit. Investment involves risks, the value of investment products may go up or down and the investment products may even become valueless. The contents above have not been reviewed by the Securities and Futures Commission.

About WeLab Bank

Welab Bank Limited ("WeLab Bank" or the "Bank"), is a homegrown virtual bank licensed by the Hong Kong Monetary Authority ("HKMA"). Founded by a team of financial and technology experts, WeLab Bank's mission is to understand customers' needs and design a personalized, intelligent banking experience that helps them manage, save and grow their money. WeLab Bank represents a 100% digital banking experience that is simple, intuitive, and built around our customers. WeLab Bank focuses on the powerful mobile app and the numberless Debit Card, both designed with an obsession with customers' experience and data security.

WeLab Bank is a wholly owned subsidiary of WeLab Holdings Limited ("WeLab"), a leading fintech company in Asia. WeLab provides a wide range of digital financial services with leading positions in Hong Kong, Mainland China, and Indonesia, with more than 50 million individual users and over 700 enterprise customers.

WeLab is backed by the most renowned investors including Allianz, International Finance Corporation (a member of the World Bank Group), Malaysian sovereign wealth fund Khazanah Nasional Berhad, CK Hutchison's TOM Group, and Sequoia Capital.

To learn more, please visit www.welab.bank and www.welab.co. Follow WeLab Bank on Instagram: welab.bank.

About Allianz Global Investors

Allianz Global Investors is a leading active asset manager with over 700 investment professionals in 23 offices worldwide and managing EUR 673 billion in assets (Data as at 31 December 2021). We invest for the long term and seek to generate value for clients every step of the way. We do this by being active – in how we partner with clients and anticipate their changing needs, and build solutions based on capabilities across public and private markets. Our focus on protecting and enhancing our clients' assets leads naturally to a commitment to sustainability to drive positive change. Our goal is to elevate the investment experience for clients, whatever their location or objectives.

Active is: Allianz Global Investors