KUALA LUMPUR, Malaysia, July 6, 2021 /PRNewswire/ -- Vynn Capital, a leading Southeast Asia venture capital firm that has invested into companies such as Carsome, Dropee and Travelio, announced today that it has joined hands with Tunku Ali Redhauddin ibni Tuanku Muhriz ("Tunku Ali"), who is now also a Partner at the firm.

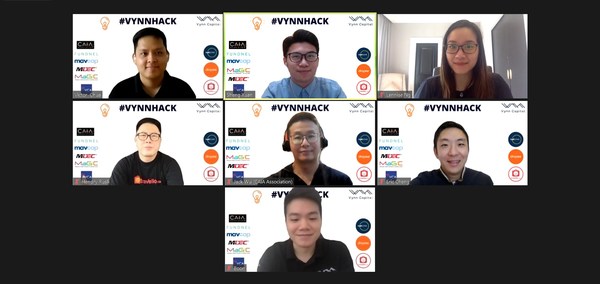

Vynn Capital and some of our portfolio companies. Top left: Victor Chua, Founding & Managing Partner of Vynn Capital; Top right: Lennise Ng, CEO and Co-Founder of Dropee; Second row far left: Hendry Rusli, CEO and Co-Founder of Travelio; Second row far right: Eric Cheng, Group CEO and Co-Founder of Carsome

Bringing over 20 years of strategic leadership, investment and governance experience, Tunku Ali will, in addition to his many other corporate, board and advisory roles, assist Vynn Capital's investment efforts in the region, helping to identify new investments as well as grow existing portfolio companies.

Tunku Ali, who has been personally investing in early stage technology companies over the past decade, said, "Partnering with Victor Chua and the team at Vynn Capital seemed a natural fit for me. Victor couples venture capital pedigree and experience, with youth and dynamism, allowing him to seek out new opportunities in this rapidly changing market, a skillset which I feel is complementary to mine."

Victor Chua, Founding & Managing Partner of Vynn Capital stated, "We are pleased to be able to work with Tunku Ali as his professionalism and wealth of knowledge will be a great asset for our investors and investees. With his experience and extensive network from across the region I look forward to engaging a broader set of investors and potential portfolio companies. At the end of the day, this is a people based business, centred on working with the right individuals and teams to build value for the whole ecosystem."

Separately, Tunku Ali is Chairman of two listed companies, Bumi Armada Berhad and Taliworks Corporation Berhad. In addition, he sits on several other boards including Bangkok Bank Berhad and Sun Life Malaysia Assurance Berhad, and chairs several non-profit institutions, including WWF-Malaysia, Teach For Malaysia, and Yayasan Munarah. He is also a Senior Advisor to TPG Capital, a global firm. Previously, Tunku Ali was a Director of Investments at Khazanah Nasional Berhad, and a management consultant with McKinsey & Company. He holds degrees from the University of Cambridge and the John F Kennedy School of Government, Harvard University, and was recognised as a Young Global Leader by the World Economic Forum in 2013.

"There is tremendous entrepreneurial energy and a thriving technology startup ecosystem in Southeast Asia today, and Vynn Capital is in the thick of it. As someone who is passionate about innovation, I am excited to be part of a firm that is fuelling the next wave of technology companies, particularly in the area of business enablement," said Tunku Ali. "In addition to investing, Vynn Capital's commitment to developing talent through hackathons and working with university students resonates well with me – we are not just investing for financial returns, but for knowledge development and positive human capital impact, which is critical for the long term sustainability of the technology industry, as well as the community as a whole."

About Vynn Capital

Vynn Capital is an early stage venture capital firm founded with the objective of bridging the gap between traditional industries and the new economies through the development of technology. Key industries of focus include Travel Mobility, Property, Food and FMCG, Female Economics as well as Business Enablers (including logistics and fintech).

The team is made up of professionals with experience across early stage investment to late stage financing, and business operations. The investment philosophy revolves around the creation of synergistic value between partners and companies supported by Vynn. Beyond investing, Vynn Capital assists its investors or Limited Partners in understanding new industries and markets with its localized team and network across the major cities of Southeast Asia. Vynn Capital is currently active in Malaysia, Singapore, Indonesia, Vietnam, Thailand and Myanmar. For more information, please visit http://www.vynncapital.com