|

SWIFT RMB Tracker shows an overall decline in RMB payments by value for 2016, closing out the year in sixth place among currencies used for international payments

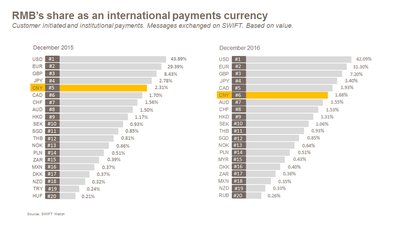

SYDNEY, Jan. 26, 2017 /PRNewswire/ -- SWIFT data shows that, compared to last year, the payments value for the RMB decreased by as much as 29.5% in 2016. The RMB's share as an international payments currency dropped from 2.31% in December 2015 to 1.68% in December 2016, ending the year as the sixth most active currency for international payments.

RMB payments value decreased by 15.08% in December 2016 compared to November 2016, whilst overall, payments value for all currencies increased slightly by 0.67%.

"The decrease in RMB usage for payments in December may be attributed to a convergence of several events: the slowdown of the Chinese economy, the volatility of the RMB exchange rate and regulatory measures on capital outflows," says Michael Moon, Head of Payments Markets, APAC, SWIFT. "Despite the slowdown, RMB internationalisation will continue to benefit from major financial infrastructure milestones, such as CIPS for cross-border clearing and additional RMB offshore clearing centres. These efforts, combined with a Memorandum of Understanding that was signed in 2016 between CIPS and SWIFT to grow payments traffic outside of China, will have a positive impact on the continued internationalisation of the currency."

About SWIFT and RMB Internationalisation

Since 2010, SWIFT has actively supported its customers and the financial industry regarding RMB internationalisation through various publications and reports. Through its Business Intelligence Solutions team, SWIFT publishes key adoption statistics in the RMB Tracker, insights on the implications of RMB internationalisation, perspectives on RMB clearing and offshore clearing guidelines, supports bank's commercial RMB product launches and provides in-depth analysis and business intelligence, as well as engaging with offshore clearing centres and the Chinese financial community to support the further internationalisation of the RMB.

The SWIFT network fully supports global RMB transactions, and its messaging services enable Chinese character transportation via Chinese Commercial Code (CCC) in FIN or via Chinese characters in MX (ISO 20022 messages). It offers a suite of dedicated RMB business intelligence products and services to support financial institutions and corporates. In addition, SWIFT collaborates with the community to publish the Offshore and Cross-Border RMB Best Practice Guidelines, which facilitate standardised RMB back office operations.

Please click here for more information about RMB Internationalisation or join our new 'Business Intelligence Transaction Banking' LinkedIn group.

For more information, visit www.swift.com.

About SWIFT

SWIFT is a global member-owned cooperative and the world's leading provider of secure financial messaging services.

We provide our community with a platform for messaging and standards for communicating, and we offer products and services to facilitate access and integration, identification, analysis and financial crime compliance.

Our messaging platform, products and services connect more than 11,000 banking and securities organisations, market infrastructures and corporate customers in more than 200 countries and territories, enabling them to communicate securely and exchange standardised financial messages in a reliable way. As their trusted provider, we facilitate global and local financial flows, support trade and commerce all around the world; we relentlessly pursue operational excellence and continually seek ways to lower costs, reduce risks and eliminate operational inefficiencies.

Headquartered in Belgium, SWIFT's international governance and oversight reinforces the neutral, global character of its cooperative structure. SWIFT's global office network ensures an active presence in all the major financial centres.

For more information, visit www.swift.com or follow us on Twitter: @swiftcommunity and LinkedIn: SWIFT

Contacts:

Cognito

swift@cognitomedia.com

+44 (0)20 7426 9400

Disclaimer

SWIFT does not guarantee the fitness for purpose, completeness, or accuracy of the RMB Tracker, and reserves the right to rectify past RMB Tracker data. SWIFT provides the RMB Tracker on an 'as is' basis, and for information purposes only. As a mere informative publication, the RMB Tracker is not meant to provide any recommendation or advice. Any person consulting the RMB Tracker remains solely and fully responsible for all decisions based, in full or in part, on RMB Tracker data. SWIFT disclaims all liability regarding a person's use of the RMB Tracker. The RMB Tracker is a SWIFT publication.

SWIFT © 2016. All rights reserved.

Photo - http://photos.prnasia.com/prnh/20170125/8521700468-a

Photo - http://photos.prnasia.com/prnh/20170125/8521700468-b

Logo - http://photos.prnasia.com/prnh/20160127/8521600559Logo