SINGAPORE, Oct. 12, 2023 /PRNewswire/ -- Global consultancy Kearney and LUXASIA, the leading omnichannel brand-builder in Asia Pacific, recently released a whitepaper titled "Unlocking hyper-growth in Asia's luxury beauty landscape", highlighting the opportunities, challenges and solutions for luxury brands in Asia. It reveals that Southeast Asia (SEA) and India are poised to be the next "gold rush" in luxury beauty, reaching a market potential of US$7.6 billion by 2026, with a projected 11% CAGR between 2021 and 2031.[1] This strong growth is expected to continue, with the market size almost tripling in 10 years.

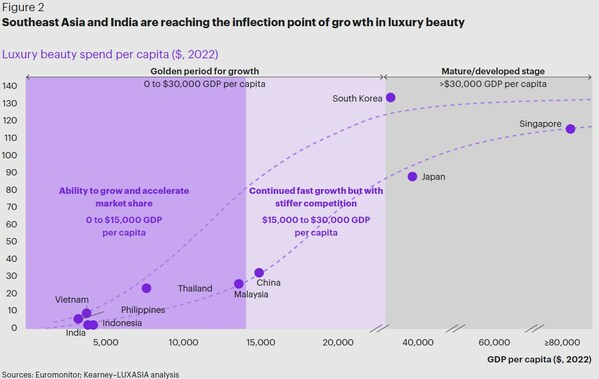

Southeast Asia (excl. Singapore) and India are slated to be the next "gold rush" in Asia's luxury beauty, approaching an inflection point for accelerated growth.

In contrast to China, Japan, Singapore, and South Korea, other markets in SEA and India are relatively unsaturated, with limited presence of both international luxury beauty brands and compelling local ones, and significant upside potential for luxury beauty spend per capita. As these economies mature, the upper- and middle-classes are projected to surpass 1 billion people in 2026[2], with more consumers expected to trade up from mass to luxury. Thus, this presents a limited but golden window of opportunity for luxury beauty brands to enter now and flourish.

However, harnessing growth remains tricky in SEA and India due to diverse market ecosystems. Luxury brands today face six major challenges in this fragmented region, which include multidimensional omni-retail networks; heterogeneous local product preferences; divergent marketing approaches; challenging regulatory frameworks; costly and idiosyncratic supply chain landscapes; and partner selection amid information asymmetry.

Correspondingly, the report outlines six execution imperatives to effectively tackle these challenges. These include optimizing the retail footprint to create multi-touchpoint experience hubs; harnessing continued e-commerce growth unique to each market; forging capabilities to ride social commerce acceleration; building deep local consumer understanding through data aggregation and analytics; leveraging logistics partners to build a robust and flexible network; and winning with the right omnichannel brand-building partners.

Siddharth Pathak, Senior Partner, Head of Consumer Industries and Retail for Asia Pacific at Kearney, said, "Southeast Asia and India should be on the agenda of every global luxury beauty CEO as these markets are poised to lead the next stage of growth in luxury beauty. To emerge successful in a competitive landscape, brands should have a cohesive strategy to cut through the noise and tap on the power of digitalization, data analytics, and ecosystem support to improve their offerings and overall resilience."

Dr Wolfgang Baier, Group CEO, LUXASIA affirms this and adds, "This golden window to capture accelerated growth cannot be missed. New-entry brands need to act urgently to secure the platform to grow. Existing market brands ought to rejuvenate their omnichannel presence, adding greater operational agility, to better navigate market developments. Backed by our track record, deep omni-network, and brand-building expertise, LUXASIA stands ready to partner all luxury beauty brands for long-term growth and success in Southeast Asia and India."

[1] According to Euromonitor and Kearney–LUXASIA analysis [2] According to World Bank, Euromonitor, and Kearney–LUXASIA analysis |