|

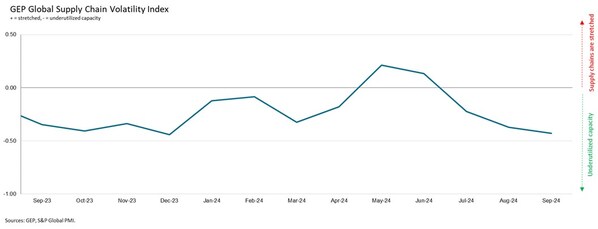

CLARK, N.J., Oct. 11, 2024 /PRNewswire/ -- The GEP Global Supply Chain Volatility Index — a leading indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — decreased in September to -0.43 (August: -0.37), its lowest level in 14 months and indicating the greatest level of global supply chain spare capacity since July 2023.

The rise in underutilized vendor capacity was driven by a further deterioration in global demand. Factory purchasing activity was at its weakest in the year-to-date, with procurement trends in all major continents worsening in September and signaling gloomier prospects for economies heading into Q4.

Notably, supplier spare capacity shot up again in North America. U.S. manufacturers lowered their purchasing volumes aggressively in September, with a slowing of the U.S. economy denting factory orders.

In Asia, supply chain spare capacity also rose to a year-to-date high. Slowing economic conditions in other parts of the globe led factory procurement activity in China to fall for a third straight month in September. There was also the devasting impact of Typhoon Yagi across Southeast Asia. Vietnam was affected in particular, causing vendor supplying this part of the region to suffer as a result.

Europe's industrial recession intensified, reflecting the blight of major manufacturers in the continent due to macro factors like competitive pressures from China, high energy costs and a flagging eurozone economy.

"September is the fourth straight month of declining demand and the third month running that the world's supply chains have spare capacity, as manufacturing becomes an increasing drag on the major economies," explained Jagadish Turimella, president, GEP. "With the potential of a widening war in the Middle East impacting oil, and the possibility of more tariffs and trade barriers in the new year, manufacturers should prioritize agility and resilience in their procurement and supply chains."

SEPTEMBER 2024 KEY FINDINGS

REGIONAL SUPPLY CHAIN VOLATILITY

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, Nov. 12, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

For more information about the methodology, click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Headquartered in Clark, New Jersey, GEP has offices and operations centers across Europe, Asia, Africa and the Americas. To learn more, visit www.gep.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world's leading organizations plan for tomorrow, today.

Media Contacts |

||

Derek Creevey |

Joe Hayes |

S&P Global Market Intelligence |