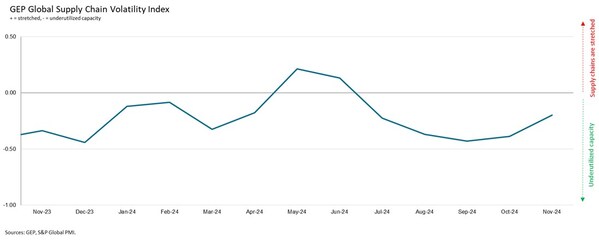

NORTH AMERICAN MANUFACTURERS BEGIN STOCKPILING TO BUFFER AGAINST TARIFFS WHILE ASIAN SUPPLIERS RECORD RENEWED GROWTH AS CHINESE MANUFACTURING REBOUNDS, DRIVEN BY STIMULUS AND EXPORTS: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* Increased safety stockpiling reported by North American manufacturers, led by the U.S., as firms anticipate higher imported costs * Asian factories' purchasing of inputs rises at the fastest rate in three-and-a-half years as firms, particularly inChina, ramp up production to meet stronger o...

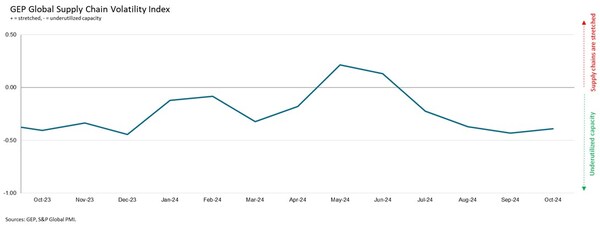

FACTORY DEMAND WEAKENS ACROSS MAJOR ECONOMIES IN OCTOBER: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* U.S. factories cut back purchases sharply, signaling heightened risks of manufacturing weakness spilling over into the broader economy in 2025 * In contrast, Chinese factories report growth following three months of shrinking input purchasing * Europe's industrial recession shows no sign o...

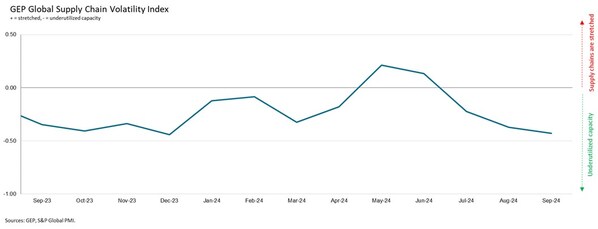

SUPPLY CHAIN SPARE CAPACITY INCREASES FOR 3RD CONSECUTIVE MONTH AND NOW AT HIGHEST LEVEL SINCE JULY 2023 AS GLOBAL ECONOMIC WEAKNESS INTENSIFIES: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* North America factory purchasing activity deteriorates more quickly in September, with demand at its weakest year-to-date, signaling a quickly slowing U.S. economy * Factory procurement activity in China fell for a third straight month, and devastation from Typhoon Yagi hit vendors feeding ...

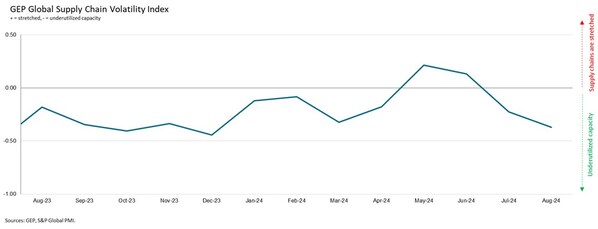

GLOBAL PURCHASING ACTIVITY CONTRACTING AT STRONGEST PACE SINCE DECEMBER 2023 AS MANUFACTURERS WORLDWIDE RETRENCH: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* North American suppliers report strong rise in excess capacity and the softest demand in eight months, with flagging factory conditions in the U.S. * Asian suppliers, who experienced growth in the first half of 2024, report spare capacity as Chinese procurement declines * Europe's manufact...

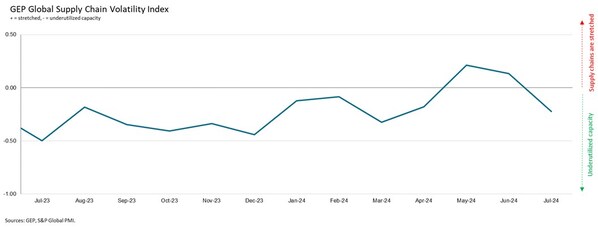

DEMAND FOR RAW MATERIALS AND SEMI-MANUFACTURED GOODS WEAKENED IN JULY, FALLING AT FASTEST RATE THIS YEAR, SIGNALLING SLOWING ECONOMIC GROWTH: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* Worldwide supply chain spare capacity rises, adding to the calls for the Federal Reserve to lower interest rates soon. * Asian factory demand at its weakest since December 2023, partly because of a notable decrease in purchasing by Chinese factories. * Suppliers to North America report und...

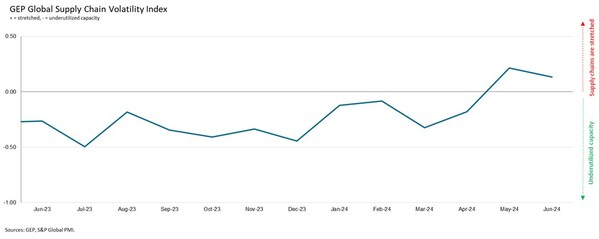

ASIA'S SUPPLIERS GROWING AT THE FASTEST PACE SINCE EARLY 2023, AS GLOBAL MANUFACTURING GATHERS FURTHER MOMENTUM IN JUNE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* Global suppliers report capacity pressures, with index in positive territory for a second consecutive month * Asian manufacturing growth accelerating in Mainland China, Taiwan, Vietnam andIndia * In contrast, demand at North American suppliers fell slightly because of lower orders, indica...

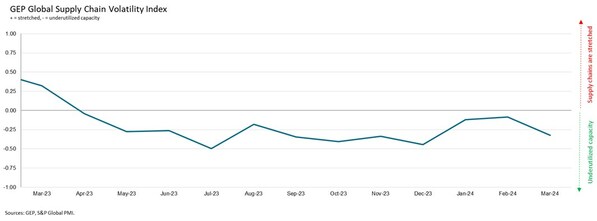

AFTER FOUR YEARS OF WILD SWINGS FROM SHORTAGES TO GLUT, GLOBAL SUPPLY CHAINS ARE NOW IN THE GOLDILOCKS ZONE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* Global supply chains are operating near maximum capacity, signaling steady outlook for the manufacturing sector * Asian factories purchase more inputs to meet growing orders, increasing pressure on the region's suppliers * North American manufacturers report some difficulties meeting order...

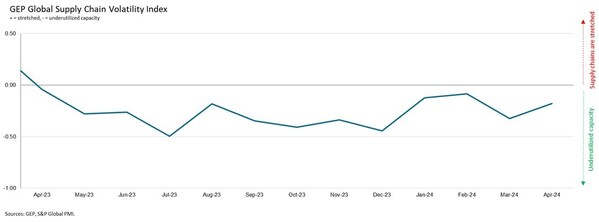

DEMAND AT ASIAN FACTORIES RISES AT STRONGEST RATE IN OVER 2 YEARS, IMPROVING NEAR-TERM GROWTH OUTLOOK FOR MANUFACTURING WORLDWIDE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* North American suppliers struggling to meet orders due to a lack of staff * Manufacturing recession in Europe eases in March, but steep downturn in Germany remains a major drag on the continent * Despite Red Sea and Panama Canal disruptions, transportation costs and stockpiling fell in Mar...

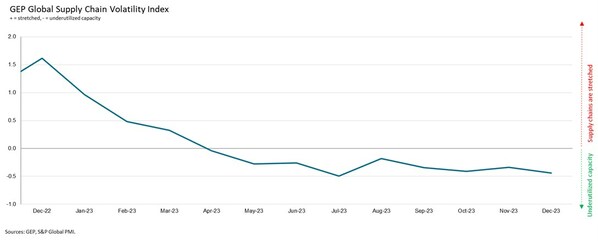

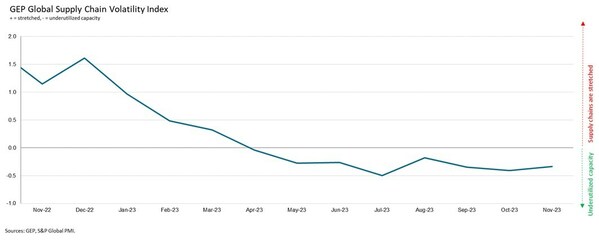

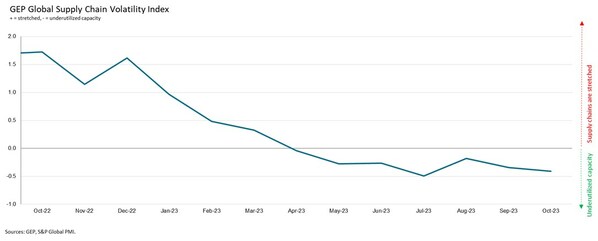

Demand for commodities, raw materials and components at its softest in nearly a year, signaling persistent weakness in the global economy: GEP Global Supply Chain Volatility Index

* Supply chain spare capacity rose in Europe, Asia and North America in December as slack reaches its greatest level sinceJuly 2023. * Notably, excess capacity at Asia's suppliers rises to a level not seen since June 2020, suggesting a manufacturing recovery is still some way off * Input dema...

CONTINUED SPARE CAPACITY AT GLOBAL SUPPLIERS WARNS OF MANUFACTURING SLUMP PERSISTING INTO 2024: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* Global producer capacity goes underutilized for an eighth successive month in November; supplier order books remain unfilled * Inactivity across Asia's supply chains bodes ill for near-term global manufacturing improvement * Demand stays subdued, especially in Europe, where manufacturing i...

NO END TO GLOBAL MANUFACTURING RECESSION IN SIGHT AS SUPPLY CHAINS WORLDWIDE REMAIN SIGNIFICANTLY UNDERUTILIZED: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

* Asia's suppliers see largest rise in idle capacity since June 2020 as the region's economic resilience fades * Europe reported a 7 th successive month of substantial excess vendor capacity, and 17th successive month of subdued demand, reflecting recessionary conditions * In contrast, supp...

FiscalNote, A Leading AI-Driven Enterprise SaaS Company that Delivers Legal and Regulatory Data and Insights, Announces Plans to Become Publicly Traded on Nasdaq Via Merger with Duddell Street Acquisition Corp.

- With its mission to connect the world to their governments, FiscalNote is a legal data and analytics company that provides more than 3,000 global subscription customers – including nearly half the Fortune 100 and hundreds of government contracts – with a robust technology platform that collect...

Results Announced for 2018 Dow Jones Sustainability Indices Review

LONDON, NEW YORK, and ZURICH, Sept. 13, 2018 /PRNewswire/ -- S&P Dow Jones Indices (S&P DJI), one of the world's leading index providers, and RobecoSAM, the investment specialist that has focused exclusively on Sustainability Investing (SI) for over 23 years, today announced the results of the an...

Results Announced for 2017 Dow Jones Sustainability Indices Review

LONDON and NEW YORK and ZURICH, Sept. 7, 2017 /PRNewswire/ -- S&P Dow Jones Indices (S&P DJI), one of the world's leading index providers, and RobecoSAM, an investment specialist focused exclusively on Sustainability Investing (SI), today announced the results of the annual Dow Jones Sustainabili...

Results Announced for 2016 Dow Jones Sustainability Indices Review

LONDON and NEW YORK and ZURICH, Sept. 8, 2016 /PRNewswire/ -- S&P Dow Jones Indices (S&P DJI), one of the world's leading index providers, and RobecoSAM, the investment specialist focused exclusively on Sustainability Investing (SI), today announced the results of the annual Dow Jones Sustainabil...