|

|

Markets.com is proud to launch Marketsi, a new way for investors to tap into financial markets

LONDON, May 13, 2020 /PRNewswire/ -- Marketsi marks a step-change in retail investing, introducing investors to quantitative investing technology with the Investment Strategy Builder. This enables investors to create and manage their own dynamic stock portfolios using the kind of data and algorithms harnessed by hedge funds and banks.

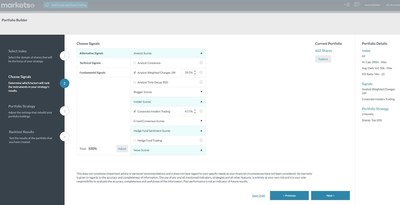

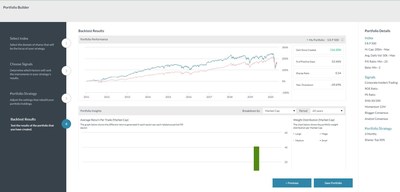

Users can access alpha-generating quant strategies and create their own unique strategies with an easy-to-use interface that lets them filter stocks based on dozens of different fundamental, technical and sentiment signals. And they can continuously backtest and optimize to find the perfect alpha-generating approach.

With Marketsi we are also offering clients a direct market access Share Dealing platform, so they can manage all their investments in one place.

And our multi-asset trading platform, Marketsx, just got a whole lot better with lower spreads, more ways to trade the most popular products and an ever-expanding universe of assets. Best of all, our tools continue to set the pace in the industry with the most impressive suite of Technical, Fundamental and Sentiment based analytical tools.

For UK clients we are now adding Spread Betting to the existing CFD trading products, giving traders the option to benefit from tax-free trading.

Markets.com CEO Joe Rundle says: "We've made a big leap into the investing space and are keen to make a splash with a product that is going to change things up for retail investors. Our quantitative-based portfolio builder lets retail investors tap into the kind of technology and data that's used by the biggest banks and hedge funds to maximise returns.

"We are super excited about launching investing products so that our clients take more control of their money. And with Spread Betting we hope to be able to meet the needs of all our UK traders.

"Our new strapline reflects our goal to be the only place you need for trading and investing: 'The world of financial markets, your way.'"

Redesigned, re-engineered, repurposed

A totally new look and feel was required to reflect the change in what we are offering our customers. So, we launched a new website that communicates our values more clearly. It's packed full of new features, while a slick new design makes it easier than ever to get to exactly where you want to be.

And we've expanded the Knowledge Centre with more analysis, insights, educational webinars and XRay, our live in-platform streaming service.

About Dynamic Portfolios

Our Investment Strategy Builder is a quantitative investment tool that enables clients to build dynamic portfolios based on pre-determined criteria. Clients can choose from a universe of stocks and narrow it down based on parameters like market cap, PE ratios or beta. They can then further fine-tune their portfolio by choosing criteria based on market-based technical signals, fundamental signals or alternative signals like when an analyst changes their rating, that will automatically rebalance the portfolio based on what they choose. Then once you have selected your portfolio you can backtest and fine-tune further.

About Us

Markets.com is the home of trading and investing. From share dealing to leveraged trading, you can control everything from one account on our intuitive, proprietary multi-asset platform. It's the only platform you'll ever need for managing your investments.

As part of the TradeTech Group, a constituent of Playtech, a FTSE 250 listed company, we have deep knowledge of the financial markets along with access to the very latest in next generation technology.

*Not all investing and trading products are available in every jurisdiction, please refer to your local regulations.